Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda[Index] [Search] [Download] [Bill] [Help]

1998-99

THE PARLIAMENT OF THE COMMONWEALTH OF AUSTRALIA

HOUSE OF REPRESENTATIVES

A NEW TAX SYSTEM (LUXURY CAR TAX) BILL 1999

EXPLANATORY MEMORANDUM

(Circulated by authority of the

Treasurer, the Hon Peter Costello, MP)

ISBN: 0642 391742

The A New Tax System (Luxury Car Tax) Bill 1999 (LCT Bill) introduces a luxury car tax, from 1 July 2000, on taxable supplies and importations of luxury cars. The luxury car tax will apply at a rate of 25% of the value above the luxury car tax threshold. The new luxury car tax replaces the existing 45% wholesale sales tax (WST) that applies to luxury cars and will ensure that, following the introduction of the goods and services tax (GST), the value of luxury cars will fall in price by about the same amount as a car just below the luxury car tax threshold.

The luxury car tax threshold is a GST - inclusive value equal to the car depreciation limit (the car depreciation limit for the 1998-99 financial year is $55,134). A system of quoting is designed to avoid the tax becoming payable until the car is sold or imported at the retail level.

The luxury car tax is in addition to any GST that is payable on a luxury car, however, it is not on top of the GST. Luxury car tax is incorporated into the net amount under the GST system or, in the case of importations, is paid with customs duty.

The additional compliance cost impact of this measure is expected to be marginal because it will utilise the same administrative framework as the GST. For example, the registration, tax period, tax invoice and general anti-avoidance provisions in the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) are used for the luxury car tax.

Unlike GST, an entity that buys a luxury car to carry on an enterprise is not entitled to an input tax credit for luxury car tax payable.

Date of effect: The LCT Bill will commence from 1 July 2000, so that luxury car tax will apply to a taxable supply or importation of a luxury car after 1 July 2000.

Proposal announced: The Government announced the proposal in Tax Reform: not a new tax, a new tax system: The Howard Government’s Plan for a New Tax System on 13 August 1998.

Financial impact: The effect of the luxury car tax on revenue cannot be separately identified from that of the GST and other tax reform measures. Since the luxury car tax will replace the existing WST luxury car tax, it is expected to neither increase nor decrease the revenue to any significant extent.

Compliance cost impact: To the extent that businesses face start-up and ongoing costs related to the GST, the additional impact of this measure will be marginal because it will utilise the same remittance framework as the GST.

Application: To coincide with the commencement of the GST and the abolition of the WST from 1 July 2000, the luxury car tax will apply to all taxable supplies and importations of luxury cars on or after 1 July 2000. Generally, luxury car tax will not apply to cars which have been subject to WST. For example, it does not apply to second hand cars that are on-hand before 1 July 2000 and supplied after. The luxury car tax will also not apply to non-registered entities. For example, a private sale of a luxury car by an individual after 1 July 2000 will not attract the luxury car tax.

• Low

• Impact will be largely offset by the abolition of the WST system.

• Businesses do face start-up and ongoing costs with luxury car tax, however, the net impact is expected to be small as the luxury car tax will utilise the same administration framework as the GST.

• Luxury car tax is paid at the retail level and not payable if the registered recipient quotes (for example, if the car is held as trading stock). Transitional arrangements apply where stock is held on 1 July 2000.

• Given that the Government will abolish the WST, and introduce a GST and luxury car tax, the overall impact on consumers is positive.

The main objective is to ensure that the price of luxury cars will fall under the new arrangements by about the same amount as a car just below the luxury car tax threshold. The luxury car tax implements the Government’s policy in Tax Reform: not a new tax, a new tax system: The Howard Government’s Plan for a New Tax System.

Consultation has been undertaken with government departments as well as preliminary consultation with industry groups in the developing stages and the Australian Taxation Office will monitor feedback on an ongoing basis.

1.1 The A New Tax System (Luxury Car Tax) Bill 1999 (LCT Bill) introduces a luxury car tax, from 1 July 2000. It is a single stage tax that is imposed on taxable supplies and importations of luxury cars and is in addition to any goods and services tax (GST) that may be payable, but is not levied on top of the GST.

1.2 In particular, the LCT Bill:

• imposes a liability for the luxury car tax on supplies and importations of luxury cars;

• allows a system of quoting which is designed to avoid the tax becoming payable until the car is sold or imported at the retail level;

• incorporates the payment of the luxury car tax into the net amount under the GST system;

• requires that for importations of luxury cars, luxury car tax is paid with customs duty (unless the importer quotes for the car);

• provides for adjustments to the net amount that arise out of circumstances that occur after the supply or importation of the luxury car (for example, bad debts); and

• provides for credits for people who are not entitled to an adjustment but who may have paid too much tax.

1.3 Chapter 1 of this explanatory memorandum (this Chapter) introduces you to the general concepts of the luxury car tax. It explains:

• the background behind the luxury car tax and also provides some information about Part 1 to the LCT Bill, which is about how the legislation is structured; and

• some of the terms used and the effect of non-operative material.

The Chapter deals with the provisions that are generally found in Part 1 to the LCT Bill.

1.4 Chapter 2 provides an explanation of the rules that establish liability for the luxury car tax. It explains when luxury car tax will apply and how it is calculated. It also provides information on the system of quoting in respect of a luxury car, to prevent the tax becoming payable until the car is sold or imported at the retail level. The Chapter deals with the provisions found in Part 2 to the LCT Bill.

1.5 Chapter 3 explains how amounts of luxury car tax are included in net amounts under the GST system, or when and how the tax will be paid if you import a luxury car. This Chapter also explains how adjustments to the net amount can arise out of circumstances that occur after the supply or importation of the car (for example, due to a bad debt). The Chapter deals with the provisions found in Part 3 to the LCT Bill.

1.6 Chapter 4 deals with some of the GST rules that will apply to you if you are liable to pay luxury car tax (for example registration, returns and anti-avoidance mechanisms). The Chapter also deals with several miscellaneous matters. For example, how the luxury car tax will be applied to the Commonwealth. The Chapter deals with the provisions generally found in Parts 4 and 5 to the LCT Bill.

1.7 Chapter 5 contains the Regulation Impact Statement which examines implementation options arising from the Government’s policy decision.

1.8 The luxury car tax will apply at a rate of 25% of the value above the luxury car tax threshold. The luxury car tax threshold is a GST-inclusive value equal to the car depreciation limit (the car depreciation limit for the 1998-99 financial year is $55,134).

1.9 The luxury car tax applies to taxable supplies of luxury cars by a registered entity. In contrast, luxury car tax applies to taxable importations of luxury cars regardless of whether or not the entity importing is registered or required to be registered.

1.10 Registered entities may quote in relation to the supply or importation of a luxury car. The quoting system is designed to avoid the tax becoming payable until the car is sold or imported at the retail level. Generally, a recipient is entitled to quote if the car supplied to them is expected to be held solely as trading stock.

1.11 The luxury car tax is paid in addition to GST above the luxury car tax threshold and GST will continue to apply to the full price of the car regardless of the price. It is expected that the additional compliance cost impact of this measure will be marginal because it will utilise the same remittance framework as the GST, that is, remitted to the Australian Taxation Office with the GST return.

1.12 Unlike the GST, no input tax credit is available for luxury car tax regardless of whether the luxury car is used within the business enterprise or for private purposes.

1.13 As mentioned above, the luxury car tax is payable in addition to GST. However, the Government’s clear intention is that luxury car tax is calculated on the value of the car after GST has been taken out. To ensure this treatment occurs, the Government will consequentially amend the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) — (refer to section 9-75 of the GST Act).

1.14 Division 1 contains preliminary information, including the title of the LCT Bill [section 1-1] and a provision which binds States and Territories to the luxury car tax [section 1-3].

1.15 Division 2 provides an overview of the luxury car tax legislation. Section 2-1 provides a brief explanation about what this legislation is about. Section 2-5 provides an overview of the luxury car tax and section 2-10 deals with paying the luxury car tax. Sections 2-15 to 2-25 deal with other miscellaneous matters.

1.16 Part 1, Division 3 tells you about identifying some defined terms that are used in the LCT Bill. Section 3-1 explains what it means when certain terms used in the LCT Bill are marked with an asterisk (*). Section 3-5 provides some common terms that are not defined in the Dictionary or use an asterisk (such as ‘luxury car tax’, ‘supply’ and ‘you’) and section 3-10 explains about defined terms identified by bold italics.

1.17 Part 1, Division 4 deals with non-operative material. [Sections 4-1 to 4-10] The Dictionary is found in section 27-1.

1.18 The purpose of the legislation is to ensure that, following the move to a GST, the price of luxury cars only falls by about the same amount as a car just below the luxury car threshold.

1.19 In a majority of cases, where new cars are sold through a dealership, liability to remit luxury car tax will rest with the registered entity supplying the car. Any luxury car tax would be remitted along with the GST return, avoiding the need for separate registration for luxury car tax purposes.

1.20 The payment, penalty, anti-avoidance and other administrative provisions in the GST Act are also linked so as to cover the luxury car tax.

1.21 The LCT Bill will commence on 1 July 2000. [Section 1-2]

1.22 Cars in general will fall in price as a result of the change from the wholesale sales tax to the GST. If the Government took no specific action, then the price of luxury cars would fall dramatically as they are currently subject to the special wholesale sales tax rate of 45% to the value above the luxury car tax threshold. The Government does not believe that this price reduction is appropriate following the replacement of the wholesale sales tax with the GST. Therefore, the Government will impose a retail tax on luxury cars, at a rate of 25% of the value above the luxury car tax threshold. The luxury car tax threshold is a GST-inclusive value equal to the car depreciation limit (the car depreciation limit for the 1997-98 financial year is $55,134). The tax will ensure that luxury cars only fall in price by about the same amount as a car just below the luxury threshold.

2.1 This Chapter deals with the provisions found in Part 2 of the A New Tax System (Luxury Car Tax) Bill 1999 (LCT Bill) and sets out when you make a taxable supply or taxable importation of a luxury car. It also describes how to work out the amount of luxury car tax on those supplies and when you are entitled to quote in respect of a supply.

2.2 You must pay luxury car tax if you make a taxable supply of a luxury car. [Section 5-5] You must also pay luxury car tax if you make a taxable importation of a luxury car. [Section 7-5] The provisions dealing with taxable supplies of luxury cars are found in Division 5 and the provisions dealing with taxable importations are found in Division 7.

2.3 When you quote in respect of a supply of a luxury car, no luxury car tax is payable for that supply. This system of quoting is designed to prevent luxury car tax becoming payable until the car is sold or imported at the retail level. The provisions that deal with quoting are found in Division 9.

2.4 If you satisfy the conditions in subsection 5-10(1), then you have made a taxable supply of a luxury car and must pay the amount of luxury car tax determined under section 5-15. However, certain supplies of luxury cars are not taxable supplies of luxury cars and as such, will not attract the tax. For example, a supply of a luxury car that is more than 2 years old is not a taxable supply of a luxury car and will not attract the tax.

2.5 Generally speaking, the supply of cars that are manufactured from cars that are over 2 years old are not taxable supplies of luxury cars (for example, the combination of two existing cars to form a new car).

2.6 The rules about taxable supplies of luxury cars are explained in paragraphs 2.7 to 2.42 of this explanatory memorandum. The rules to determine the amount of luxury car tax payable are explained in paragraphs 2.43 to 2.68.

2.7 You make a taxable supply of a luxury car if you satisfy all of the following conditions:

• you supply a luxury car;

• the supply is made in the course or furtherance of an enterprise that you carry on;

• the supply is connected with Australia; and

• you are registered, or required to be registered.

[Subsection 5-10(1)]

2.8 These concepts are explained in more detail immediately below. However, subsection 5-10(2) provides some exceptions to these concepts, so you must also refer to these to determine whether or not you will be liable to pay the luxury car tax (refer to paragraph 2.25 to 2.42 for further information on these exemptions).

2.9 A luxury car is defined in terms of whether the value of the car exceeds the luxury car tax threshold. [Subsection 25-1(1)] If it does, and is not specifically excluded from the definition, then it is a luxury car. If it does not, or if the car is specifically excluded from the definition, then it is not a luxury car and will not be subject to the luxury car tax.

2.10 The term car is defined in the Dictionary and means a motor vehicle (except a motor cycle or similar vehicle) designed to carry a load of less than 2 tonnes and fewer than 9 passengers. A motor vehicle is defined to mean a motor-powered road vehicle (including a 4-wheel drive vehicle). Therefore, the definition of car includes all passenger cars including station wagons, all 4-wheel drives, light trucks, motor homes, campervans and hearses.

2.11 The luxury car tax threshold is the car depreciation limit that applies under Subdivision 42-B of the Income Tax Assessment Act 1997 (ITAA 1997) for the year in which the supply of the car occurred. [Subsection 25-1(3)] Refer to paragraphs 2.62 to 2.63 for more information on the luxury car tax threshold.

2.12 Certain vehicles are specifically excluded from the definition of luxury car, ie. prescribed emergency vehicles and certain vehicles used for transporting disabled people. However, note that the exemption does not extend to all vehicles used by a particular class mentioned in the exemption, only the specific cars themselves. Also note that these exemptions are in addition to a supply excluded from a taxable supply of luxury cars that are found in subsection 5-10(2).

2.13 A vehicle, or class of vehicle, that is specified in the regulations to be an emergency vehicle, is not a luxury car. It is intended that this would cover vehicles such as ambulances. [Paragraph 25-1(2)(a)]

2.14 Therefore, the regulations will prescribe what vehicle or class of vehicle will be an emergency vehicle and the supply of such a vehicle, regardless of whether or not it exceeds the luxury car tax threshold, will not attract luxury car tax.

2.15 Cars that are specially fitted out for transporting disabled people seated in wheelchairs are excluded from the definition of luxury car, and are not subject to luxury car tax. [Paragraph 25-1(2)(b)] The definition of disabled person is defined in the Dictionary to mean a disabled veteran (as described in paragraphs 38-505(1)(a) and (b) of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) or a person with a disability certificate (as described in paragraph 38-510(1)(a) of the GST Act).

2.16 However, according to paragraph 25-1(2)(b), if the supply of the car is goods and services tax (GST) – free under Subdivision 38-N of the GST Act, then the car is a luxury car if its value is greater than the luxury car tax threshold, and would be subject to luxury car tax. The policy is intended to replicate the treatment given to vehicles under WST whereby motor vehicles that are specially fitted out for transporting disabled persons seated in wheelchairs are excluded from the 45 % WST rate unless it is exempt because it is for an eligible disabled person (refer to Item 1(2) of Schedule 6 of the Sales Tax (Exemptions & Classifications) Act 1992 (ST(E&C) Act 1992).

2.17 Therefore, a vehicle that exceeds the luxury car tax limit can either be supplied GST - free or luxury car tax free, but not both.

2.18 The concept of supplying a luxury car is intended to be broad and is based on the similar concept of ‘taxable supply’ found in the GST Act. Accordingly, a supply is any form of supply whatsoever and includes retail and wholesale sales. The following are some examples of a supply of a luxury car:

• A car dealer sells a car to an individual or business. Usually in this case, title of the car passes from the manufacturer to the finance company to the dealership to the end customer at the time of sale. Each stage of this transaction would be a separate supply of a car.

• An entity provides a luxury car to an employee either as a bonus or as part of a salary package.

• The sale of a car to a Commonwealth or State or Territory department or agency or statutory authority.

2.19 The term in the course or furtherance is not defined in the LCT Bill, but is broad enough to cover any supplies made in connection with your enterprise. An act done for the purpose or object of furthering an enterprise, or achieving its goals, is a furtherance of an enterprise although it may not always be in the course of that enterprise (see for example the New Zealand Case N43 (1991) 13 NZTC 3361). The term is also used in the GST Act (refer to subsection 9-5(b) of the GST Act). [Paragraph 5-10(1)(b)]

2.20 The term in the course or furtherance does not extend to the supply of private commodities, such as when a car dealer sells his or her own private car. However, it would cover a sale of a car by a car dealership in the ordinary course of carrying on that dealership and may also extend to a sale of a car by a sole trader who is registered for GST purposes, but only if the sale is in the course or furtherance of the sole trader’s enterprise.

2.21 The term carrying on an enterprise is defined in the Dictionary to include doing anything in the course of the commencement or termination of the enterprise. The term enterprise refers to the same term as used in the GST Act and is intended to be as wide as possible.

2.22 The term connected with Australia is defined in the Dictionary as having the meaning given by section 9-25 of the GST Act. Generally, it is intended to cover all supplies of luxury cars that are:

• delivered or made available in Australia to the recipient of the supply;

• removed from Australia; or

• brought to Australia (including luxury cars that are assembled in Australia).

[Paragraph 5-10(1)(c)]

2.23 In order to make the administration of the luxury car tax simpler, you will not be required to separately register for both GST and luxury car tax. If you are registered or required to be registered under the GST Act, then you may be liable to pay luxury car tax if you make a taxable supply or importation of a luxury car. [Paragraph 5-10(1)(d)]

2.24 Since the rules that apply to registration under the GST Act will also apply for luxury car tax some of the key rules have been provided in this explanatory memorandum, however, you should examine the GST Act to determine if you are required to be registered. For further information on registration, refer to paragraph 4.9 in Chapter 4.

2.25 Not all supplies of cars are subject to luxury car tax. The LCT Bill provides a few circumstances where a supply of a car is not a taxable supply of a luxury car, and therefore not subject to luxury car tax. The main circumstance where a supply is not a taxable supply is where a person ‘quotes’ for the supply of the car. This is a special feature of the luxury car tax that allows registered entities to delay the incidence of tax until the retail sale.

2.26 In particular, the LCT Bill provides that you do not make a taxable supply of a luxury car if:

• the recipient quotes for the supply of the car;

• the car is more than 2 years old; or

• you export the car in circumstances where the export is GST - free under Subdivision 38-D of the GST Act.

[Subsection 5-10(2)]

2.27 Further explanation of these terms is now given.

2.28 In certain circumstances you can quote your Australian Business Number (ABN) for a supply or importation of a luxury car and not pay the luxury car tax.

2.29 The provisions that deal with quoting are found in Part 2, Division 9. Under this Division, you do not make a taxable supply of a luxury car if the recipient quotes for the supply of the car. [Paragraph 5-10(2)(a)] You are only entitled to quote if you are registered [subsection 9-5(2)] and if you intend to use the car one of the following purposes, and for no other purpose:

• you hold the car for trading stock, other than holding it for hire or lease;

• you carry out research and development for the manufacturer of the car; or

• you export the car in circumstances where the export is GST - free under Subdivision 38-D of the GST Act.

2.30 The LCT Bill provides specific rules that deal with quoting. For example, periodic quoting; the manner in which quote must be made; and incorrect quoting. These matters are dealt with at the end of this Chapter in paragraphs 2.84 to 2.93.

[Subsection 9-5(1)]

2.31 As mentioned previously, the LCT Bill provides that if you are registered for GST and quote your ABN because you intend to hold the car as trading stock, then the supply of the car to you is not a taxable supply of a luxury car, and you are not liable for luxury car tax in relation to that supply.

2.32 If you hold a car for hire or lease, then you are not entitled to quote in respect of that car. The supply to you is a taxable supply and will attract luxury car tax.

2.33 Paragraph 9-5(1)(b) of the LCT Bill allows a manufacturer to supply a car to an external entity in order for that entity to conduct research and development activities on behalf of the manufacturer when the entity carrying out the research and development has quoted.

2.34 Research and Development is defined in the Dictionary to mean:

‘systematic, investigative and experimental activities that involve innovation or high levels of technical risk and are carried on for the purpose of:

• acquiring new knowledge (whether or not that knowledge will have a specific practical application); or

• creating new or improved materials, products, devices or processes.’

2.35 The policy intention is to apply equal treatment to those manufacturers who contract out their research and development activities and those manufacturers who choose to conduct these activities themselves.

2.36 The third circumstance in which you can quote is where you intend to export the car, and the export is GST – free under Subdivision 38-D of the GST Act. [Paragraph 9-5(1)(c)] Further information on exporting is found in paragraphs 2.40 to 2.42 of this explanatory memorandum.

2.37 You are not liable to pay luxury car tax if you supply a car that is more than 2 years old at the time of the supply. [Paragraph 5-10(2)(b)] This provision works in conjunction with the rule that allows previously paid luxury car tax to be credited against amounts of luxury car tax (see paragraphs 2.65 to 2.68) and prevents the luxury car tax becoming payable indefinitely on supplies of luxury cars. However, different rules apply to determine if a car is more than 2 years old for the purposes of this Bill, depending on whether the car was imported or not.

2.38 If a car has not been, (and has never been), imported into Australia, then paragraph 5-10(3)(a) operates so that the car is not subject to luxury car tax if it is manufactured more than 2 years before the time of the supply. For example, a car manufactured in Australia in January 2001 and supplied in February 2003 will be more than 2 years old at the time of supply and is not subject to the luxury car tax. You will also need to refer to transitional arrangements that apply to sales of cars that were subject to a retail sale before 1 July 2000 in the A New Tax System (Wine Equalisation Tax and Luxury Car Tax Transition) Act 1999.

2.39 If a car has been imported into Australia, then paragraph 5-10(3)(b) operates so that the car is not subject to luxury car tax if more than 2 years have lapsed since the time of importation

2.40 The Government’s policy is that GST is a tax on consumption in Australia and generally, things that are not for consumption in Australia, such as exports, are GST - free. Similarly, a supply of a luxury car that is exported is not for consumption in Australia and is generally not a taxable supply of a luxury car, and hence not subject to luxury car tax.

2.41 Paragraph 5-10(2)(c) of the LCT Bill provides that if you export a car in circumstances where the export is GST - free under Subdivision 38-D of the GST Act, then the supply of that car to you is not a taxable supply of a luxury car.

2.42 You will need to refer to Subdivision 38-D of the GST Act to determine whether or not the supply is GST - free. Some key rules about exports are as follows:

• A supply of goods is GST - free if you export the goods within 60 days after the earlier of the:

• day you receive any of the consideration; or

• day you provide an invoice.

• A supply of goods is GST - free if the consideration for the export is provided in instalments under a contract which requires the goods to be exported and you export the goods within 60 days after the earlier of the:

• final instalment of the consideration; or

• day you provide an invoice for the final instalment.

2.43 Generally speaking, the amount of luxury car tax payable on a taxable supply of a luxury car is:

• the amount determined using the formula (see paragraph 2.47)

minus

• any amounts of luxury car tax that have been payable in respect of any previous importation or supply of that car, taking into account any adjustments made (see paragraphs 2.65 to 2.68).

2.44 The formula calculates the difference between the value of the luxury car and the luxury car tax threshold (refer to paragraphs 2.47 to 2.64). Since the luxury car tax value (generally, the price paid for the car) is GST inclusive, the formula then operates to take this out before applying the luxury car tax rate of 25% to the difference that exceeds the threshold.

2.45 The next step is to determine whether there have been any amounts of luxury car tax paid on any previous supply or importation of that car (refer to paragraphs 2.65 to 2.68). If there has, then this reduces the amount of luxury car tax payable determined under the formula.

2.46 A more detailed explanation of these calculations now follows.

2.47 The amount of luxury car tax payable on a taxable supply of a luxury car is calculated using the formula in subsection 5-15(1). This formula is:

2.48 The luxury car tax value of a supply of a car is the price of the car excluding:

• any luxury car tax payable on the supply; and

• any other Australian tax, other than GST and customs duty, payable on the supply.

[Section 5-20]

2.49 The term price is further defined in the Dictionary as having the meaning given by section 9-75 of the GST Act, which states:

price is the sum of:

• so far as the consideration for the supply is consideration expressed as an amount of money–the amount (without any discount for the amount of GST (if any) payable on the supply); and

• so far as the consideration is not consideration expressed as an amount of money–the GST inclusive market value of that consideration.

2.50 Price is generally the amount of money paid for the car, however, this is not always the case. Therefore, if the consideration for the supply is not in money, or not only in money, the price is determined according to the above rules.

Important note: At the time of writing this explanatory memorandum, the GST Act, as currently drafted, may have the effect of including luxury car tax in the luxury car tax value. This is clearly not the Government’s intention and as such, section 9-75 of the GST Act will be amended to ensure that price excludes amounts of luxury car tax.

2.51 Paragraph 5-20(1)(a) provides that the price of the supply excludes any amounts of luxury car tax included in that supply (note that previous luxury car tax amounts are taken into account under subsection 5-15(2)). The price also excludes any other Australian tax (including motor vehicle registration and third-party insurance), other than customs duty and GST. [Paragraph 5-20(1)(b)]

2.52 The LCT Bill provides special provisions that may impact on the luxury car tax value. These matters are listed below, and a brief explanation on each is given.

• A supply of a car to an associate etc.

• Additional supplies and modifications for cars

• Modifications for disabled people

• Agreements with the Commissioner of Taxation

2.53 The luxury car tax value of a car is the GST inclusive market value of the car, excluding any luxury car tax payable on the supply, if you:

• supply a luxury car to your associate, or your employee, or an officer of either your associate or of you; and

• you do not receive any consideration for the supply or if the consideration is less than the GST inclusive market value of the car.

[Subsection 5-20(2)]

2.54 The terms GST inclusive market value, associate, officer and consideration are further defined in the Dictionary.

2.55 Subsection 5-20(3) provides that, in certain circumstances, the luxury car tax value of a car includes the price of all supplies and modifications in relation to that car. This feature is designed to prevent additional supplies and/or modifications being made to a car after the point of sale and excluded from luxury car tax.

2.56 Subsection 5-20(3) will apply to you if you supply a luxury car and you, or your associate, provide additional supplies and/or modifications to that car, or that are paid for by the recipient, that are:

• made before the end supply of the car; or

• made under an arrangement made with you or your associate, at or before the time of the end supply of the car.

2.57 For example, if a person buys a car from a car dealer who arranges for modifications and/or additional supplies to be made or added to that car, then the luxury car tax value of the car must include the price of those modifications and/or additional supplies. This is the case regardless of whether the modifications or additional supplies are made or added to the car, before or after the time of sale.

2.58 Subsection 5-20(4) provides that the price of the supply is the GST inclusive market value of the car where:

• a car is supplied by an associate of the recipient, and

• there is no consideration for the supply or the consideration is less than the GST inclusive market value of the car.

2.59 The luxury car tax value does not include modifications made to a car that are solely for the purpose of:

• adapting it for driving by a disabled person; or

• adapting it for transporting a disabled person.

[Subsection 5-20(5)]

2.60 A disabled person is defined in the Dictionary to mean a person who is a disabled veteran (as described in paragraphs 38-505(1)(a) and (b) of the GST Act) or a person with a disability certificate (as described in paragraph 38-510(1)(a) of the GST Act).

2.61 The Commissioner of Taxation may enter into an agreement with you about calculating the luxury car tax values of particular supplies or importations of luxury cars. So far as the agreement is inconsistent with the LCT Bill, the agreement prevails. [Section 21-10]

2.62 The next step of the formula is to subtract the luxury car tax threshold from the luxury car tax value.

2.63 The luxury car tax threshold is GST inclusive and is the car depreciation limit that applies under Subdivision 42-B of the ITAA 1997 for the year in which the supply of the car occurred. [Subsection 25-1(3)] The car depreciation limit for the 1998-99 financial year is $55,134.

2.64 The rate of luxury car tax of 25% is applied to the difference between the luxury car tax value and the luxury car tax threshold under subsection 5-15(1). However, since the luxury car tax value is the price of the car inclusive of GST, and the luxury car tax threshold is a GST inclusive amount, the GST has to be removed before then applying the luxury car tax rate of 25% to the balance. The formula does this by applying the fraction 10/11 to the difference.

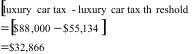

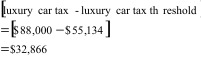

Example:

Peter buys a car from Paul’s CarMart, with a GST inclusive price of $88,000. This price includes GST payable on the supply, but excludes the luxury car tax on the supply. The luxury car tax value determined under section 5-20 is therefore $88,000. Assume that the luxury car tax threshold is $55,134, and there are no other charges connected with the supply.

The amount of luxury car tax payable is determined using the following steps:

Step 1. Calculate the amount to be subject to luxury car tax

![]()

![]()

Step 2. Since the amount calculated above ($32,866) includes GST, the

next step is to multiply by 10/11 to take this out

![]()

![]()

Step 3. The effect of step 2 is that the luxury car tax applies to

$29,878 rather than $32, 866. That is, you do not pay luxury car tax on the

difference of $2,988. The amount that is left is then multiplied by the luxury

car tax rate of 25%.

![]()

![]()

The total amount that Peter has to pay Paul for the car is:

2.65 The amount of luxury car tax payable on a taxable supply of a luxury car is reduced by the sum of all luxury car tax that was payable in respect of any previous importation or supply of the car. [Subsection 5-15(2)] The effect of this provision is that once luxury car tax is applied to the value of a car, it will not become payable again, unless the value of the car increases. If the value of the car does increase, and there is a further taxable supply, luxury car tax will only apply to the extent of the increase.

2.66 In some cases, the amount of luxury car tax payable on a taxable supply of a luxury car is less than the sum of all luxury car tax that was payable in respect of any previous importation or supply of the car. If this is the case, then the amount of luxury car tax payable on that supply is zero. [Subsection 5-15(2)]

2.67 For example, if a car is sold (assume a taxable supply of a luxury car) for $100,000 in February 2001, then luxury car tax is payable. If the same car is again sold (assume a taxable supply of a luxury car) in February 2002 for $80,000, then no luxury car tax will apply. The reason for this is because the luxury car tax payable on the second supply is less than the luxury car tax payable on the first.

2.68 In determining the luxury car tax that was payable in respect of any previous importation or supply of a car for the purposes of paragraph 5-15(2)(b), you must take into account luxury car tax adjustments, if any, other than adjustments made because of bad debts. [Subsection 5-15(3)]. For more information on adjustments, please refer to paragraphs 3.17 to 3.33 in Chapter 3 of the explanatory memorandum.

2.69 We have just dealt with how luxury car tax will apply to a taxable supply of a luxury car. Luxury car tax will also apply if you import a luxury car into Australia. The provisions that deal with taxable importations of luxury cars are found in Division 7 of the LCT Bill.

2.70 The following paragraphs now deal with taxable importations of luxury cars. The rules regarding taxable importations of luxury cars are explained in paragraphs 2.72 to 2.80 of this explanatory memorandum. The rules to determine the amount of luxury car tax payable are explained in paragraphs 2.81 to 2.83.

2.71 An important difference between a taxable supply and a taxable importation of luxury car is that there is no registration requirement for a taxable importation, and the importer need not be carrying on an enterprise. Luxury car tax is generally payable in both of these cases.

2.72 Section 7-5 provides that you must pay the luxury car tax payable on any taxable importation of a luxury car that you make. Under subsection 7-10(1), you make a taxable importation of a luxury car if you import the luxury car.

2.73 The term import has the same meaning as in the GST Act, so you will need to check this to determine if you import a luxury car. Generally, you make an importation of goods into Australia under Division 13 of the GST Act, if:

• you enter the goods for home consumption (within the meaning of the Customs Act 1901); and

• at the time they are so entered for home consumption, you are the owner (within the meaning of the Customs Act 1901) of the goods.

2.74 The importation of the car will include any car parts, accessories or attachments that you import at the same time as the car and that could reasonably be expected to be fitted to the car. [Subsection 7-10(2)] The term car parts has the same meaning as given in section 195-1 of the GST Act, and are generally essential to the operation of the car. The terms accessories and attachments are peripheral items and include such things as car stereos, air conditioning units, car alarms, spare tyres and car jacks.

2.75 The Bill provides that you do not make a taxable importation of a luxury car in the following circumstances:

• you quote for the importation of the car; or

• luxury car tax has already become payable in respect of the car; or

• the car is covered by Item 17, 18A, 18B, 18C, 21 or 24 in Schedule 4 to the Customs Tariff.

[Subsection 7-10(3)]

2.76 Further explanation of these circumstances is now given.

2.77 If you are registered, you can quote in respect of an importation of a luxury car in the same circumstances as for a taxable supply of a luxury car. For example, if you are a registered dealer and import a car that you hold as trading stock, you may quote your ABN to Customs. Refer to paragraphs 2.28 to 2.36 for information on when you can quote. [Paragraph 7-10(3)(a)]

2.78 You do not make a taxable importation of a luxury car if luxury car tax has already become payable in respect of that car. This may apply where you have paid the luxury car tax payable on a luxury car and then later export it. When you re-enter that car into Australia you are generally not required to pay luxury car tax again (assuming you have not made an adjustment or claimed back the previous luxury car tax). [Paragraph 7-10(3)(b)]

2.79 Under paragraph 7-10(3)(c) and subsection 7-10(4), a car that is covered by certain items in Schedule 4 to the Customs Tariff will not be subject to luxury car tax at the time it is imported. A summary of these items is provided in the following table:

|

Item Number

|

Deals with...

|

|

Item 17

|

goods exported from Australia in an unaltered condition.

|

|

Item 18A

|

goods previously imported and returned after repair overseas under warranty

provisions.

|

|

Item 18B

|

goods supplied free of charge to replace goods or parts under

warranty.

|

|

Item 18C

|

goods supplied free after a global product safety recall.

|

|

Item 21

|

goods, as prescribed by by-law, imported for repair, alteration or

industrial processing and are to be exported.

|

|

Item 24

|

Personal bequeathed goods that are not to be sold or to be used for

purposes of trade.

|

2.80 However, note that this does not prevent these cars from becoming subject to luxury car tax, if they later satisfy the conditions of a taxable supply or are re-imported into Australia.

![]()

![]()

2.81 The amount of luxury car tax payable on a taxable importation is worked out in a similar way to luxury car tax payable on a taxable supply (refer to paragraphs 2.43 to 2.64). It is determined by the formula:

[Section 7-15]

2.82 However, there are some important differences that you should note in respect of luxury car tax value.

2.83 Under section 7-15, the luxury car tax value of a car is the sum of:

• the customs value of the car and of any car parts, accessories or attachments covered by subsection 7-10(2). Customs value is determined under Division 2 of Part VIII of the Customs Act 1901; [Subsection 7-15(a)] and

• the amount paid or payable:

• to transport the car and any parts etc. to Australia; and

• to insure the car and any parts etc. for that transport

to the extent that the amount is not already included in the customs value; [Subsection 7-15(b)] and

• any customs duty payable in respect of the importation of the car and of any parts etc.; [Subsection 7-15(c)] and

• any GST payable in respect of the importation of the car and of any parts etc. (Note the effect of the formula is to remove the GST component so as not to apply luxury car tax to it). [Subsection 7-15(d)]

2.84 The circumstances in which you can quote for a supply or importation of a luxury car and not pay the luxury car tax are set out in Division 9 of the LCT Bill and are explained in paragraphs 2.28 to 2.36, and 2.77 of this explanatory memorandum. The remainder of this Chapter deals with the special rules that apply where you quote. In particular it covers:

• periodic quoting;

• the manner in which a quote must be made; and

• improper and incorrect quotes.

2.85 The Bill allows you to make a periodic quote for supplies that you intend to receive from a supplier during the period covered by the periodic quote. The period must not exceed 12 months. [Subsection 9-10(1)] This is similar to a periodic quote allowed under the WST system.

2.86 If you make a periodic quote on or before the first day of the period to which the quote relates, you are to be treated as having quoted your ABN for all supplies from the supplier during that period. However, this periodic quote does not relate to supplies for which you are not entitled to quote. If you are not entitled to quote for a particular supply (for example, you intend to use a luxury car as a demonstration vehicle, rather than for trading stock) you must notify the supplier of that fact at or before the time of supply. [Subsections 9-10(2) and (3)]

2.87 If you are in breach of subsection 9-10(3), then you are guilty of an offence. The maximum penalty under subsection 9-10(4) is 20 penalty units.

2.88 Subsection 9-10(5) provides that a periodic quote is not effective if there are grounds for believing it is improperly made (refer to paragraph 2.91 for more information.)

2.89 Subsection 9-15(1) provides that a quote (including a periodic quote) must be in the approved form. The meaning of approved form is found in section 25-5 and provides that a notice, application or other document is in the approved form if:

• it is in the form approved in writing by the Commissioner in relation to that kind of notice, application or other document; and

• it contains the information that the form requires, and such further information as the Commissioner requires; and

• it is given, to the entity to which it is required to be given, in the manner (if any) that the Commissioner requires; and

• it is, if required by this Bill to be given to the Commissioner, lodged at the place that the Commissioner requires.

2.90 Further, a quote is not effective unless it is made at or before the time of the supply or importation of the luxury car. [Subsection 9-15(2)]

2.91 If a person to whom you provide a quote have reasonable grounds for believing that:

• you are not entitled to quote in the particular circumstances;

• the quote is not made in the approved form; or

• the quote is false or misleading in a material particular (either because of something stated in the quote or something left out),

then, the quote that you give to that person is not effective, and you may have to pay any luxury car tax payable. If you were entitled to quote in this case, you can later use the adjustment provisions to adjust the amount of luxury car tax that should have been paid.

[Section 9-25]

2.92 Section 9-30 provides an offence for improper quoting. The maximum penalty under this section is 20 penalty units.

2.93 If you quote in circumstances in which you are not entitled to quote, the Bill allows that quote to be effective in certain circumstances. [Section 9-20]

3.1 Luxury car tax on supplies of luxury cars is added to the net amount under Division 17 of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act). Adjustments in relation to supplies or importations of luxury cars can also be made to net amounts. These may increase or decrease the net amount.

3.2 Luxury car tax on importations of luxury cars is not incorporated into the net amount but is generally paid with customs duty.

3.3 This Chapter sets out how you pay the luxury car tax. It also describes how to work out luxury car tax adjustments to the net amount and when you can claim credits of luxury car tax that has been overpaid.

3.4 Luxury car tax is in addition to any goods and services tax (GST) that is payable on a car. The luxury car tax payable by you on taxable supplies of luxury cars is attributed to a tax period and added to the net amount under Division 17 of the GST Act for that tax period. [Section 13-5]

3.5 If you have a positive net amount, the GST Act requires you to pay that amount to the Commissioner. Generally, you must pay it on or before the 21st day of the month following the end of your tax period to which the payment relates. See paragraph 4.10 for a discussion of net amount.

3.6 Similarly, any luxury car tax adjustments attributable to the tax period will alter the net amount for that tax period. Any increasing luxury car tax adjustments will be added to the net amount for the period, while any decreasing luxury car tax adjustments will be subtracted from the net amount for the tax period. Luxury car tax adjustments must be made within 4 years after the tax period to which the original supply or importation relates. [Section 13-10]

3.7 Luxury car tax payable by you will be attributable to the same tax period that the GST on the supply is attributable to under Division 29 of the GST Act. If the supply of the luxury car is not a taxable supply under the GST Act, then luxury car tax is attributable to the tax period it would have been attributable to if it were a taxable supply. [Subsection 13-15(1)]

3.8 Division 29 of the GST Act generally requires that all the GST on a taxable supply is attributable to the tax period in which the earliest of the following occurs:

• you receive any consideration for the supply; or

• an invoice is issued in relation to the supply.

3.9 However, different rules apply if you account on the cash basis. If you account on the cash basis, GST is attributable to the tax period or periods in which the consideration is received, and only to the extent of the amount of consideration received in each tax period.

3.10 Similarly, luxury car tax adjustments are attributable to the same tax period that the GST adjustment on the supply is attributable to under Division 29 of the GST Act. If the luxury car tax adjustment does not also give rise to a GST adjustment, then the luxury car tax adjustment is attributable to the tax period it would have been attributable to if it were a GST adjustment. [Subsection 13-15(2)]

3.11 Division 29 of the GST Act generally requires that a GST adjustment is attributable to the tax period in which you became aware of the adjustment.

3.12 However, a decreasing adjustment arising from an adjustment event is only attributable to that tax period if the entity holds an ‘adjustment note’ at the time of lodging its GST return. Instead, the adjustment is attributable to the first tax period in which the entity holds the adjustment note when it lodges its return. See section 29-10 of the GST Act.

3.13 If you account on the cash basis, adjustments arising from adjustment events where (further) consideration is liable to be paid are attributable to the tax period or periods in which the consideration is provided, and only to the extent of the consideration provided in each period.

3.14 Luxury car tax on importations is generally payable at the same time and place, and in the same manner as customs duty is, or would be, payable on the car. The Regulations can allow further time for payment and accordingly can specify the place and manner of payment. [Section 13-20]

3.15 In some situations, an import may only be made temporarily. That is, a car is brought into Australia with the intention to take it out of Australia again, for example, the importation of a rally car for a world cup event held in Australia. In these situations, customs duty may be able to be delayed if the importer gives a security or undertaking to the Australian Customs Service for payment of the duty. Luxury car tax on such importations is delayed until the customs duty becomes payable. [Section 13-25]

3.16 Section 13-30 expressly states that Division 165 of the GST Act, the general anti-avoidance provisions, applies to luxury car tax payable upon an importation of a luxury car as if it were payable under the GST Act. See paragraph 4.14 for a discussion of the general anti-avoidance provisions.

3.17 Adjustments arise out of circumstances that occur after the supply or importation. They increase or decrease the net amount. They can be made by the supplier, or the recipient or the importer, depending upon the circumstances. Adjustments will ensure that the correct amount of luxury car tax is imposed.

3.18 An increasing luxury car tax adjustment will increase your net amount. A decreasing adjustment will decrease your net amount.

3.19 A luxury car tax adjustment can arise because of:

• an adjustment event;

• a change of use of the car; or

• a bad debt being written off.

3.20 If a luxury car tax adjustment event occurs resulting in an incorrect amount of luxury car tax being paid, you must adjust your net amount. A luxury car tax adjustment event would be an event such as the:

• cancellation of the supply of the luxury car;

• changing of the consideration for the supply, such as through a volume discount; or

• supply becoming, or stops being, subject to luxury car tax.

[Section 15-5]

3.21 You make an adjustment to your net amount for a tax period if:

• you have a luxury car tax adjustment event;

• luxury car tax on the supply was attributable to an earlier tax period; and

• the luxury car tax previously attributed is no longer correct because of the adjustment event.

[Section 15-10]

3.22 The amount of the luxury car tax on the supply calculated taking into account any luxury car tax adjustments is the corrected luxury car tax amount. [Paragraph 15-10(c)]

3.23 The amount of luxury car tax that was attributable to an earlier tax period is the previously attributed luxury car tax amount. It includes any luxury car tax adjustments previously made for that supply of the luxury car. [Section 15-15]

3.24 If the corrected luxury car tax amount is greater than the previously attributed luxury car tax amount, you will have paid less luxury car tax than you should. You will have an increasing luxury car tax adjustment of an amount equal to the difference between the corrected luxury car tax amount and the previously attributed luxury car tax amount. [Section 15-20]

3.25 If the corrected luxury car tax amount is less than the previously attributed luxury car tax amount, you will have paid more luxury car tax than you should. You will have a decreasing luxury car tax adjustment of an amount equal to the difference between the previously attributed luxury car tax amount and the corrected luxury car tax amount. [Section 15-25]

3.26 Change of use adjustments can occur where:

• you quoted on a supply or importation of a luxury car and you subsequently use the car for a purpose other than a quotable purpose; or

• you did not quote on a supply or importation of a luxury car but should have because you intend to use, and have only used, the car for a quotable purpose.

See paragraphs 2.28 to 2.36 for discussion of when you can quote.

3.27 The correct amount of luxury car tax would not have been paid in either of these circumstances.

3.28 You have a decreasing luxury car tax adjustment if:

• you were supplied with, or imported, a luxury car;

• luxury car tax was payable because you did not quote;

• you were registered at the time of supply or importation; and

• you have used, and intend to use, the car only for a quotable purpose.

[Subsections 15-30(1) and 15-35(1)]

3.29 For example, a car dealer did not quote when he purchased a luxury car because the car was to be used by the executives of the dealership. Luxury car tax was paid on the supply. However, when the car was delivered the executives didn’t use the car themselves but instead held it solely for trading stock. The car dealer is able to claim a decreasing luxury car tax adjustment.

3.30 The amount of the decreasing luxury car tax adjustment is equal to the amount of luxury car tax that was paid on the supply or importation. [Subsections 15-30(2) and 15-35(2)]

3.31 You have an increasing luxury car tax adjustment if:

• you were supplied with, or imported, a luxury car;

• either:

• no luxury car tax was payable because you quoted; or

• you had a decreasing luxury car tax adjustment because of a change of use; and

• you use the car for a purpose other than a quotable purpose.

[Subsections 15-30(3) and 15-35(3)]

3.32 For example, the above car dealer quoted when purchasing 10 luxury cars to be held as trading stock. No luxury car tax was paid on the supply. The car dealer later used one of the cars as a demonstration vehicle. Since the car is being used for a purpose other than a quotable purpose, the car dealer will have an increasing luxury car tax adjustment.

3.33 The amount of the increasing luxury car tax adjustment is equal to the amount of:

• luxury car tax that would have been payable on the supply or importation if you had not quoted; or

• the previous decreasing luxury car tax adjustment.

[Subsections 15-30(4) and 15-35(4)]

3.34 If you account for GST other than on a cash basis you may account for luxury car tax on the supply of a luxury car before you receive any or all of the consideration for the supply. If you have accounted for luxury car tax on a supply and you later write off as a bad debt some or all of the consideration you were due to receive for the supply, you will have accounted for luxury car tax but not have received an amount for that luxury car tax from the recipient of the supply.

3.35 You have a decreasing luxury car tax adjustment to reduce your net amount in the tax period in which you write off the debt, if:

• you made a taxable supply of a luxury car;

• the whole or part of the consideration for the supply has not been received; and

• you write off as bad the whole or a part of the debt.

[Subsection 15-40(1)]

3.36 The decreasing luxury car tax adjustment is the amount of the luxury car tax payable on the amount written off. Subsection 15-40(2) shows how to calculate the decreasing luxury car tax adjustment.

3.37 If you previously wrote off a bad debt for a taxable supply of a luxury car, had a decreasing luxury car tax adjustment, and later recover some or all of the debt, you will not have paid luxury car tax on the amount recovered. You have an increasing luxury car tax adjustment to increase your net amount in the tax period that you receive some or all of the debt. [Subsection 15-45(1)]

3.38 The increasing luxury car tax adjustment will be the amount of luxury car tax payable on the amount recovered. Subsection 15-45(2) shows how to calculate the increasing luxury car tax adjustment.

3.39 You may be entitled to claim a credit for luxury car tax paid by yourself or the supplier of the luxury car. Credits are only available to people who are not entitled to an adjustment and may arise because the luxury car tax on the supply was overpaid, either because of an error in the calculation or by being unable to quote at the time of the supply or importation. Credits will ensure that the correct amount of luxury car tax is imposed.

3.40 You may claim a credit if:

• you have a credit entitlement;

• you are not registered or required to be registered; and

• no one else has made a valid claim for a credit in relation to the credit entitlement.

[Section 17-5]

3.41 A credit entitlement will arise if you have borne:

• overpaid luxury car tax on a supply to you. For example, where the supplier charged more luxury car tax than was legally payable; or

• luxury car tax on a supply, or importation, of a luxury car which was acquired for a quotable purpose but you were unable to quote because you were unregistered. An example may be where an unregistered research and development company acquired a luxury car to conduct research and development for the manufacturer of the car.

[Subsections 17-5(2), (3) and (4)]

3.42 The Dictionary at section 27-1 defines when you have borne luxury car tax. Subsection 17-5(5) sets out the amount of credit you are entitled to.

3.43 To receive a credit, you must claim the credit, in the approved form, within 4 years of becoming entitled to the credit. [Section 17-10]

4.1 The following Chapter provides an explanation of the miscellaneous provisions of the luxury car tax and identifies some provisions of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) which will apply to the luxury car tax.

4.2 Division 21 of the A New Tax System (Luxury Car Tax) Bill 1999 (LCT Bill) contains administrative provisions unique to the functioning of the LCT Bill. Most of the provisions that support the collection and administration of luxury car tax, such as penalty provisions and information sharing, will be contained in new Part VI of the Taxation Administration Act 1953.

4.3 Liability to luxury car tax cannot extend to the Commonwealth or to a defined category of a Commonwealth entity. To ensure that Commonwealth entities are also effectively covered by luxury car tax, the entities will be notionally liable to luxury car tax and notionally have luxury car tax adjustments. [Section 21-1]. If you supply a luxury car to a Commonwealth entity you are required to charge luxury car tax on the value of the car above the luxury car tax threshold.

4.4 This provision expressly overrides an existing Commonwealth law that would otherwise provide an exemption from liability to luxury car tax. [Section 21-5]

4.5 The Criminal Code will apply to all offences under the LCT Bill. [Section 21-10]

4.6 The Governor-General will be authorised to make regulations prescribing matters that are either required or permitted by the LCT Bill to be prescribed, or that are necessary or convenient to be prescribed for carrying out or giving effect to the LCT Bill. [Section 21-15]

4.7 Rather than separately remitting the amount of luxury car tax on taxable supplies of luxury cars that is payable by you, you attribute the luxury car tax to a tax period and incorporate it in your net amount for that tax period under Division 17 of the GST Act. See paragraphs 3.4 to 3.13. Certain provisions of the GST Act apply to you. These include provisions dealing with:

• registration;

• net amount;

• tax periods;

• tax invoices;

• goods and services tax (GST) returns; and

• general anti-avoidance.

4.8 A general guide to those provisions is provided below. However, you should examine the GST Act to determine how they apply to your particular circumstances.

4.9 You are not required to be separately registered for luxury car tax. The rules that apply to registration under the GST Act will apply. Some of the key rules are:

• If you are carrying on an enterprise, you are required to be registered for GST if your annual turnover or your projected annual turnover is $50,000 or above.

• If your current annual turnover is less than $50,000 you are not required to be registered. However, you will be required to register if the Commissioner of Taxation (Commissioner) is satisfied that your projected annual turnover is above $50,000.

• Even if you are not required to be registered for GST you can choose to register if you are carrying on an enterprise. You may also choose to register if you are not carrying on an enterprise but intend to do so in the future.

• Generally, you register by applying to the Commissioner for registration in the form approved by the Commissioner. If you are not already registered, you must apply for registration within 21 days of becoming required to be registered.

• Generally, the date of effect of your registration will be the date you put in your application. However, there are provisions that enable the Commissioner to specify another date.

4.10 The net amount is the sum of GST attributable to the tax period, less the input tax credits that are attributable to that period. The amount of luxury car tax payable by you is included in your net amount. Some of the key rules are:

• If your net amount is greater than zero, you must pay that amount to the Commissioner.

• If your net amount is less than zero, your net amount (expressed as a positive amount) is the amount the Commissioner must pay to you for that tax period.

• If your net amount is zero, you are not liable to pay anything to the Commissioner nor are you entitled to a refund from the Commissioner.

4.11 Tax periods are the periods for which you work out your net amount. You are required to lodge a GST return for each tax period that applies to you. Some of the key rules are:

• Generally, your tax periods will be quarterly and end on 31 March, 30 June, 30 September and 31 December. However, you may elect to account on a monthly basis. These will be the calendar months of the year.

• You must use calendar month tax periods if:

• your annual turnover is at or above the tax period turnover threshold (currently $20 million);

• you will only be carrying on your enterprise in Australia for less than three months;

• the Commissioner is satisfied that you have a history of not complying with your tax obligations; or

• you have a substituted accounting period for income tax.

• To fit in with the end of one of your commercial accounting periods, you can end your tax period seven days earlier or later than when the relevant tax period would otherwise end. Your next tax period starts on the day after the day on which your tax period now ends.

4.12 A tax invoice substantiates a creditable acquisition and is generally issued by suppliers. The GST Act requires that tax invoices must:

• show the Australian Business Number of the entity issuing it;

• show the price for the supply;

• contain such information as the regulations require; and

• be in the form approved by the Commissioner.

4.13 If you are registered or required to be registered, you must lodge a GST return for each tax period that applies to you. Some of the key rules are:

• You must give your return to the Commissioner on or before the 21st day of the month following the end of the tax period to which the return relates.

• Your GST return must be in the approved form, state your net amount (including luxury car tax on taxable supplies of luxury cars) and include any other information required by the approved form. The return must be signed.

• You must lodge a return even if your net amount is zero or you made no taxable supplies that are attributable to that tax period.

• You may lodge your GST return electronically.

• You are required to lodge electronically if your annual turnover is at or above the electronic lodgement turnover threshold (currently $20 million).

4.14 Division 165 of the GST Act, the general anti-avoidance provisions, applies to amounts of luxury car tax payable. This is achieved by incorporating luxury car tax payable on taxable supplies of luxury cars in the net amount under Division 17 of the GST Act. However, luxury car tax on importations of luxury cars is not incorporated into the net amount but is generally paid with customs duty. Section 13-30 expressly states that Division 165 of the GST Act applies to amounts payable upon an importation of a luxury car as if it were payable under the GST Act.

• Division 165 of the GST Act will operate to deter avoidance schemes that are designed to obtain GST benefits by taking advantage of GST law in circumstances other than that intended by GST tax law.

• The general anti-avoidance rules will only apply to negate any GST benefit under a scheme if it can be established that the dominant purpose for entering into the scheme or principal effect of the scheme is to give an entity any such benefit.

5.1 The Government announced the proposal in Tax Reform: not a new tax, a new tax system: The Howard Government’s Plan for a New Tax System on 13 August 1998.

5.2 Under the present wholesale sales tax (WST) system, if the wholesale value of a car exceeds the luxury threshold ($55,720 tax inclusive retail price), tax is applied at the general rate of sales tax (22%) up to the threshold, with a special 45% rate applying to the excess.

5.3 The policy objective of this measure is to maintain existing Government policy with respect to the taxation of luxury cars relative to non-luxury cars by ensuring that after the introduction of the goods and services tax (GST), luxury cars fall in price only by about the same amount as a car just below the luxury threshold.

5.4 The policy objective will be achieved by introducing a retail tax of 25% on luxury cars (above a GST-inclusive threshold) after the introduction of the GST. Luxury car tax will be levied on taxable supplies and importations of luxury cars at the retail level. To exclude wholesale transactions, a registered entity will be able to quote if the car is to be used for certain purposes (eg. held for trading stock). A key component of this measure is that businesses subject to GST will not be able to obtain an input tax credit for the luxury car tax on luxury cars.

5.5 This RIS will deal with:

• A New Tax System (Luxury Car Tax) Bill 1999;

• A New Tax System (Luxury Car Tax Imposition - General) Act 1999.

• A New Tax System (Luxury Car Tax Imposition - Customs) Act 1999;

• A New Tax System (Luxury Car Tax Imposition - Excise) Act 1999;

• A New Tax System (Indirect Tax Administration) Act 1999;

• A New Tax System (Wine Equalisation Tax and Luxury Car Tax Transition) Act 1999;

5.6 The purpose of a taxation RIS is to examine implementation options arising from the Government’s policy decision. Accordingly, the RIS is based on the policy design of the luxury car tax, outlined below, and focuses on the best ways to implement the policy within the policy objectives set.

5.7 The implementation of the luxury car tax will occur against the background of the removal of the WST and the implementation of the GST.

5.8 To achieve the effect of replacing the WST luxury car rate, the luxury car tax will generally be levied at the point of retail sale.

5.9 To ensure that tax is paid at the retail level a system of quotation will be implemented. For example, luxury car tax is not payable if the registered recipient intends to use the car as trading stock unless it is held for hire or lease. Unregistered persons unable to quote will pay luxury car tax to customs when they import luxury cars.

5.10 There will be approximately 800 regular annual payers of luxury car tax. However, the imposition of this measure will be largely offset by the benefits to business from the Government’s abolition of the WST system. In addition, because all of the businesses affected by the luxury car tax will also be required to comply with the GST the net impact of this measure on businesses will be small.

5.11 Businesses will be able to claim a credit for WST embedded in stock on hand on 1 July 2000. The credit will be included in the net amount in their GST return. Effectively, this is the difference between the luxury car tax and the WST already paid. Many businesses already undertake an annual stocktake and will not incur any additional cost.

5.12 Businesses should not incur any additional recurrent compliance costs for the luxury car tax.

5.13 The Government will also be affected by this measure, in particular, the Australian Taxation Office (ATO) and the Australian Customs Service. However, because the luxury car tax will utilise the same administration framework as the GST, the net impact of this measure is expected to be small.

5.14 Given the abolition of the WST, and the introduction of the GST and a lower luxury car tax rate of 25%, the impact of this measure on consumers will be positive. The price of luxury cars will fall under the new arrangements by about the same amount as non-luxury cars. Overall non-luxury car prices for consumers are expected to fall by around 8.3%.

5.15 It is very difficult to quantitatively assess the compliance costs for business of this measure (net of the GST) because it is linked so closely to the operation of the GST. To the extent that businesses face start-up and ongoing costs related to the GST, the additional impact of this measure will be marginal because it will utilise the same remittance framework as the GST.

5.16 Moreover, taxpayers that remit luxury car tax are likely to receive more in benefits (due to cash flow benefits) than costs incurred.

5.17 WST on cars is actually calculated by applying a statutory formula to the recommended retail price. Payment of WST is usually deferred until the sale of the car to the final consumer. In order to avoid double taxation (luxury WST and luxury car tax) during the transition, businesses will be able to claim WST paid on stock held on 1 July 2000 as an input tax credit, under Part 4 of the A New Tax System (Goods and Services Tax Transition) Act 1999.

5.18 Without transitional arrangements in place, there is a risk that some retailers would face double taxation.

5.19 All LCT taxpayers are GST payers and will be included in the field coverage for GST. The LCT will cover an estimated 1550 motor vehicle dealers, with an estimated 800 being liable for regular payment of

LCT. The costs that the ATO expects to incur in administering the LCT are set out in the following table.

|

COST TYPE

|

YEAR (1999/2000 PRICES)

|

|||

|

Business line resource costs

Salary

Administrative funds

Corporate flow-ons

Total administrative costs

|

1999-2000

$000

$500

$100

$850

$1,450

|

2000-2001

$000

$500

$100

$850

$1,450

|

2001-2002

$000

$500

$100

$850

$1,450

|

2002-2003

$000

$500

$100

$850

$1,450

|

5.20 The revenue from the luxury car tax is expected to raise approximately $175 million in 2000-01; $205 million in 2001-02; and $210 million in 2002-03.

5.21 Consultation has been undertaken with relevant Government departments in the development of this measure. Representations were also received from industry groups.

5.22 The above measure implements a luxury car tax in a way consistent with the Government’s policy position in Tax Reform: not a new tax, a new tax system: The Howard Government’s Plan for a New Tax System.

5.23 The Treasury and the ATO will monitor this measure, as part of the whole taxation system, on an ongoing basis. In addition, the ATO has consultative arrangements in place to obtain feedback from professional and business associations through other taxpayer forums.