Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda[Index] [Search] [Download] [Bill] [Help]

2004

THE PARLIAMENT OF THE COMMONWEALTH OF AUSTRALIA

HOUSE OF

REPRESENTATIVES

JAMES HARDIE (INVESTIGATIONS AND

PROCEEDINGS)

BILL 2004

EXPLANATORY MEMORANDUM

(Circulated by authority of the Treasurer,

the Hon Peter

Costello, MP)

Table of Contents

|

1

|

1.1 The James Hardie (Investigations and Proceedings) Bill 2004 (the Bill) is intended to facilitate a comprehensive investigation of matters arising from the New South Wales Special Commission of Inquiry into the Medical Research and Compensation Foundation (the James Hardie Special Commission of Inquiry) and any proceedings that may arise from those investigations.

1.2 There is considerable community concern about the conduct of James Hardie across a number of years and particularly in relation to the separation of subsidiary companies with liabilities via a group restructure, the transfer of key assets offshore in that restructure and the subsequent underfunding of obligations to compensate those victims who have a legitimate claim against James Hardie for asbestos-related diseases. These obligations have been recently estimated at approximately $1.5 billion. However, the figure could be as high as $2 billion as the number of victims identified increases. This figure may increase further as the second and third waves of people who have been exposed to asbestos products manufactured by James Hardie contract asbestos-related diseases. A thorough investigation of the conduct of James Hardie, with proceedings brought where misconduct is found, is essential to maintaining community confidence in the Australian corporate regulatory regime.

1.3 The effect of the principal provision of the Bill is to expressly abrogate legal professional privilege in relation to certain materials, allowing their use in investigations of James Hardie and any related proceedings. This means that authorised persons, including ASIC and the DPP, will be able to obtain materials that would otherwise be subject to legal professional privilege and use them for the purposes of certain investigations and proceedings.

1.4 The investigation of possible contraventions of the Corporations Act may be impaired if ASIC and the DPP cannot obtain and use material obtained by the Special Commission which is subject to claims of legal professional privilege. It is expected that many crucial documents will be subject to claims of privilege by James Hardie. The transactions that will be the subject of investigation are of a complex nature, and were the subject of extensive legal advice and assistance. Materials documenting this advice may offer critical evidence as to the purpose and nature of certain transactions. Such evidence may be unavailable from any other source.

1.5 The Bill will confirm a longstanding interpretation of ASIC’s investigative and enforcement powers which was cast into doubt by the decision of the High Court in 2002 in the Daniels case. That case created some uncertainty as to whether the 1991 decision of the High Court in the Yuill case would be followed today if a request by ASIC to produce material subject to legal professional privilege was to be challenged.

|

2

|

2.1 The following abbreviations are used in this Explanatory Memorandum.

|

ACCC

|

Australian Competition and Consumer Commission

|

|

ASIC

|

Australian Securities and Investments Commission

|

|

ASIC Act

|

Australian Securities and Investments Commission Act 2001

|

|

DPP

|

Director of Public Prosecutions (Commonwealth)

|

|

James Hardie Special Commission of Inquiry

|

New South Wales Special Commission of Inquiry into the Medical Research and

Compensation Foundation

|

|

JHIL

|

James Hardie Industries Limited

|

|

MRCF

|

Medical Research and Compensation Foundation

|

|

TPA

|

Trade Practices Act 1974

|

|

3

|

3.1 The Bill has no significant financial impact on Commonwealth expenditure or revenue.

|

4

|

4.1 Clause 1 is a formal provision specifying the short title of the Bill.

4.2 Clause 2 provides that the Bill commences on the day after it receives the Royal Assent. The proposed commencement date will ensure that persons who fail to produce a privileged document to an authorised person on the day the Bill receives the Royal Assent, but at a time earlier than when the Governor-General assents to the Bill, are not then retrospectively at risk of being found to have failed to produce a document without lawful excuse.

4.3 Clause 3 defines terms used in the Bill, and identifies various persons, entities, transactions and material relevant to the investigation by ASIC of matters arising out of the James Hardie Special Commission of Inquiry. Key terms are expanded upon below. In brief, the definitions have been drafted with a view to ensuring that the abrogation of legal professional privilege applies only to information required by investigatory and enforcement bodies, but without circumscribing their ability to use this material.

4.4 This definition identifies a class of persons who, notwithstanding the existence of legal professional privilege, may request or require the provision of James Hardie material or exercise certain powers under the ASIC Act, or receive James Hardie material, for the purposes of a James Hardie investigation or proceeding.

4.5 The class of persons includes ASIC, an ASIC delegate, persons who exercise certain powers under the ASIC Act, the DPP and any person who has initiated a James Hardie proceeding.

4.6 The term includes natural persons. ASIC can delegate its powers or functions (including its investigative and enforcement powers) to another person under section 102 of the ASIC Act. Under subsection 102(6) of the ASIC Act, a thing done by a delegate under a delegated power is taken to have been done by ASIC.

4.7 In addition, any material that is received by an authorised person after the commencement of the Bill falls within the definition of James Hardie material provided it is relevant to a James Hardie investigation or James Hardie proceeding. This covers material that is voluntarily provided to ASIC.

4.8 Subclause 5(5) preserves claims of legal professional privilege made by an authorised person in relation to James Hardie material.

4.9 This definition has been used with a view to consistency with terms used in the Criminal Code Act 1995, so that conduct includes representations that may be made by a person.

4.10 This definition provides a convenient summary term including the head companies of James Hardie at various times, any entities that were related to or controlled by those head companies, and other entities that were involved in the James Hardie restructure. The definition is used as a key concept in defining the scope of later defined terms including ‘James Hardie material’, ‘James Hardie investigation’ and ‘James Hardie proceeding’. The definition is much broader than the usual meaning of a corporate group, and includes entities that were established as part of the restructure that resulted in the isolation of the asbestos liabilities (the MRCF group of companies and discretionary trust) and the isolation of the former head of the corporate group, JHIL (the ABN 60 companies).

4.11 This definition identifies key matters that fall within the scope of the defined term ‘James Hardie investigation’. It is intended to capture the series of transactions that led to the separation of obligations to compensate people who have or are likely to suffer loss as a result of asbestos-related diseases.

4.12 The term ‘reorganisation’ is used in its ordinary sense, specifically the third definition provided in the Federation Edition of the Macquarie Dictionary, which states that ‘reorganisation means a thorough or drastic reconstruction of a business company, including a marked change in capital structure, often following a failure and receivership or bankruptcy trusteeship’.

4.13 An exposition of the key restructure events is provided in the following extract from the submission by the partners of the legal firm, Allens Arthur Robinson, dated 14 July 2004 to the James Hardie Special Commission of Inquiry (note that the entity referred to below as ABN 60 Foundation Pty Ltd was incorporated as ABN 60 Foundation Limited):

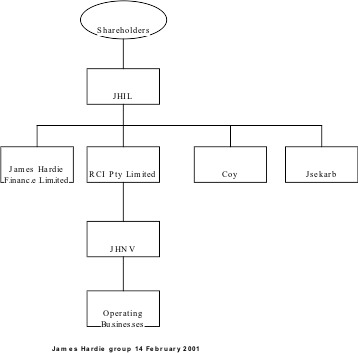

On 16 February 2001, James Hardie announced the establishment of the MRCF, a charitable trust which would hold the shares (not the businesses) of two former asbestos subsidiaries of the group. The company which made the announcement, James Hardie Industries Limited (JHIL), was then the parent of the James Hardie Group (it was listed on the Australian Stock Exchange in 1951).

The two subsidiaries which were transferred by JHIL to the MRCF, Amaca Pty Limited and Amaba Pty Limited, had previously been known as James Hardie & Coy Pty Limited (Coy) and Jsekarb Pty Limited (Jsekarb). Both of those companies had in the past been involved in the manufacture and sale of products containing asbestos. Coy was incorporated in 1937 and from that date had carried on substantially all of the James Hardie Group’s asbestos cement business in Australia. Jsekarb was incorporated in 1962 and had been involved in the manufacture of asbestos brake pads.

(In a restructuring of the group in 1998, the core operating businesses of the group had been transferred to subsidiaries of a group company known as James Hardie NV. In the case of operating companies with prospective asbestos liabilities, such as Coy, the businesses of those companies were sold to subsidiaries of James Hardie NV but the shares in those companies were not. As a result, immediately prior to the establishment of the MRCF, Coy and Jsekarb remained directly held subsidiaries of JHIL but were not subsidiaries of James Hardie NV. Coy held substantial assets, representing the proceeds of the sale of its business to a subsidiary of James Hardie NV.)

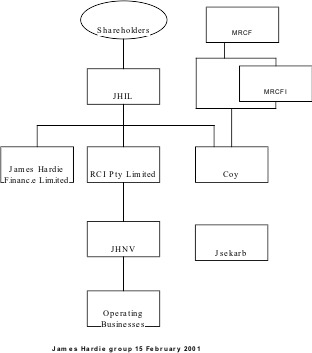

On 15 February 2001, Jsekarb became a wholly owned subsidiary of Coy (in a transaction by which Jsekarb issued 1,000 ordinary shares to Coy and cancelled all of the shares held by JHIL in Jsekarb). On the same day, each of the MRCF (a company limited by guarantee and the trustee of the Medical Research & Compensation Foundation trust) and its wholly owned subsidiary MRCF (Investments) Pty Limited were issued with 500 shares in Coy.

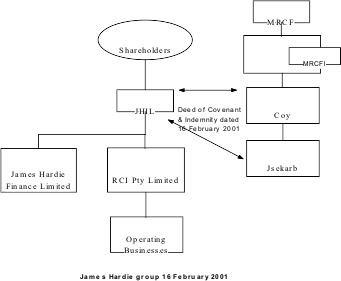

On 16 February 2001, Coy and Jsekarb became wholly owned subsidiaries of the MRCF (because the remaining shares held by JHIL in Coy were cancelled). Immediately prior to that cancellation, JHIL entered into a Deed of Covenant & Indemnity with Coy and Jsekarb under which, amongst other things, JHIL undertook to make payments totalling $112.5 million over 42 years in return for an indemnity and covenant not to sue in relation to certain asbestos claims and inter-company transactions.

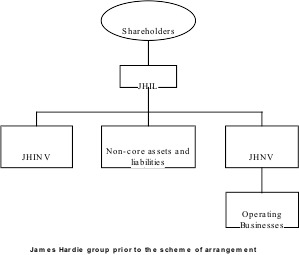

In October 2001, the James Hardie Group was restructured under a scheme of arrangement approved by shareholders on 28 September 2001 and by the Supreme Court of New South Wales on 8 October 2001. Prior to the implementation of the scheme, a group company then known as RCI Netherlands Holdings BV was renamed James Hardie Industries NV (JHINV) and transferred within the group such that it became a subsidiary of JHIL but was no longer a holding company of James Hardie NV (JHNV). As a result, the structure of the group prior to the implementation of the scheme was as follows.

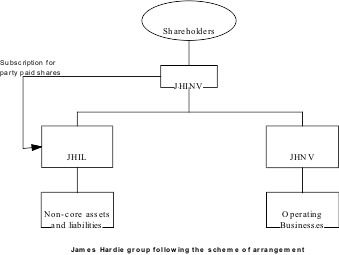

Under the scheme of arrangement, ownership of JHNV was transferred from JHIL to JHINV and shareholders exchanged their shares in JHIL for shares in JHINV. As a result, JHINV became the ultimate holding company within the group. Also as part of the scheme of arrangement, the new parent (JHINV) subscribed for partly paid shares in the former parent (JHIL) with an issue price calculated by reference to the market capitalisation of JHIL prior to implementation of the scheme. As a result of the scheme of arrangement the structure of the group was as follows.

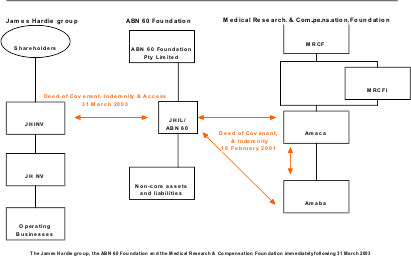

On 15 March 2003, JHIL, now known as ABN 60 Pty Limited (ABN60), cancelled all of the partly paid shares then on issue to JHINV. On 31 March 2003, ABN 60 issued 1000 shares to ABN 60 Foundation Pty Limited, the trustee of a new charitable trust (to be known as the ABN 60 Foundation), and cancelled the remaining shares held by JHINV in ABN 60. As a result, ABN 60 became a wholly owned subsidiary of ABN 60 Foundation Pty Limited and ceased to be a member of the James Hardie Group. Immediately prior to the cancellation of shares on 31 March 2003, ABN 60 entered into a Deed of Covenant, Indemnity & Access with JHINV.

JHIL continues to owe substantial payment obligations to Amaca and Amaba under the Deed of Covenant & Indemnity dated 16 February 2001.

4.14 This definition identifies the material in relation to which legal professional privilege may be abrogated by this Bill. The definition includes the records produced to, or created by, the James Hardie Special Commission of Inquiry, which were transferred from the NSW Government to ASIC under the Special Commission of Inquiry (James Hardie Records) Act 2004 (NSW). James Hardie material also includes books and information obtained after the commencement of the Bill, by ASIC, an ASIC delegate or the DPP under their normal powers, provided that the material is for the purposes of, or in connection with, a James Hardie investigation or a James Hardie proceeding. The material might be obtained in a number of different ways — for example, it may be obtained by ASIC in the exercise of its investigative powers under Part 3 of the ASIC Act or under a warrant issued under section 36 of the ASIC Act. It should be noted that although this Bill will conclusively prevent a person from refusing to produce books or provide information to ASIC on the ground of legal professional privilege, ASIC must be exercising its powers of investigation in accordance with the ASIC Act. The term ‘record’ has the same meaning as in the NSW Act. The term ‘books’ has the same meaning as in subsection 5(1) of the ASIC Act. To avoid uncertainty in situations where material is provided voluntarily, the definition also includes material that is received after the commencement of the Bill by an authorised person, provided that the material is relevant to a James Hardie investigation or a James Hardie proceeding.

4.15 This definition identifies the nature of ASIC investigations for which legal professional privilege in James Hardie material will be abrogated. The scope of these investigations is limited to matters that have been identified to date as involving possible misconduct, particularly conduct that may have contributed to the separation and underfunding of obligations to compensate people who have suffered loss or damage as a result of exposure to asbestos. The definition includes the investigation of any James Hardie Group restructure event to ensure that ASIC can fully investigate these key events. The scope of the term ‘James Hardie investigation’ may be extended in the future if necessary through use of the regulation-making power in clause 7 of the Bill. An event prescribed for the purposes of this paragraph must relate to the James Hardie Group (as defined).

4.16 This definition identifies the proceedings in which legal professional privilege in James Hardie material is to be abrogated. The scope of these proceedings is limited to proceedings brought by ASIC, an ASIC delegate or the DPP relating to conduct of the James Hardie Group (or an officer, employee or adviser thereof) or that relates to the subject of a James Hardie investigation.

4.17 The term ‘proceeding’ in this Bill has the same meaning as in the ASIC Act and includes: a proceeding in a court; or a proceeding or hearing before, or an examination by or before, a tribunal; whether the proceeding, hearing or examination is of a civil, administrative, criminal, disciplinary or other nature. A James Hardie proceeding would include a civil proceeding under section 50 of the ASIC Act, which ASIC may cause to be begun and carried on in a person’s name.

4.18 The definition in the Bill includes the common law immunity of legal professional privilege (being a substantive rule of law as well as a rule of evidence). The definition also includes the statutory rights referred to as ‘client legal privilege’ in the Evidence Act 1995 (Cth) (the Evidence Act) and in similar legislation of a State or Territory, namely, the Evidence Act 1995 (NSW) and the Evidence Act 2001 (Tas) (Uniform Evidence Acts).

4.19 The doctrine of legal professional privilege has been described by the High Court in Daniels Corporation International Pty Ltd v Australian Competition and Consumer Commission (2002) 213 CLR 543 (Daniels case) as follows:

It is now settled that legal professional privilege is a rule of substantive law which may be availed of by a person to resist the giving of information or the production of documents which would reveal communications between a client and his or her lawyer made for the dominant purpose of giving or obtaining legal advice or the provision of legal services, including representation in legal proceedings.

4.20 The central tenet of the decision in the Daniels case was that legal professional privilege is an important common law right that cannot be abrogated by statute without express words or an unmistakeable implication.

4.21 Subclause 4(1) of the Bill clearly states that legal professional privilege is abrogated in relation to James Hardie material for the purposes of, or in connection with, a James Hardie investigation or a James Hardie proceeding. To avoid doubt, the Bill defines ‘legal professional privilege’ to include privilege under Division 1 of Part 3.10 of the Evidence Act, or a similar law of a State or Territory.

4.22 Any uncertainty over the power to obtain and use privileged material has the potential to severely inhibit ASIC’s ability to exercise efficiently its information-gathering and investigative powers in relation to the conduct that gave rise to the James Hardie Special Commission of Inquiry. Subclause 4(1) puts this matter beyond doubt.

4.23 As recognised by the High Court in the Daniels case, legal professional privilege is not merely a rule of substantive law but an important common law right. Nevertheless, there are situations in which its abrogation is justified in order to serve higher public policy interests. One such situation is the effective enforcement of corporate regulation.

4.24 The community must have confidence in the regulation of corporate conduct, financial markets and services. This confidence would be undermined if ASIC was unduly inhibited in its ability to obtain and use material necessary to conduct investigations and take enforcement action where appropriate in relation to matters arising from the James Hardie Special Commission of Inquiry and any subsequent investigations and prosecutions instigated by the regulator.

4.25 In relation to matters concerning, or arising out of, the James Hardie Special Commission of Inquiry, the Government considers that it is clearly in the public interest that any investigation and subsequent action by ASIC and the DPP be unfettered by claims of legal professional privilege.

4.26 To avoid any doubt as to the effect of the abrogation in subclause 4(1), subclause 4(2) provides that a claim of legal professional privilege in relation to James Hardie material does not prevent an authorised person from exercising relevant powers to obtain that material for the purposes of, or in connection, with a James Hardie investigation or proceeding.

4.27 Subclause 4(3) clarifies that section 69 of the ASIC Act, which provides that a lawyer is entitled to refuse to give information or produce a book where doing so would involve disclosing a privileged communication made by the lawyer, does not apply to James Hardie material for the purposes of, or in connection with, a James Hardie investigation or proceeding.

4.28 Subclause 4(4) provides that claims of legal professional privilege made in relation to James Hardie material, including a claim of client legal privilege available under Division 1 of Part 3.10 of the Evidence Act, or under a similar law of a State or Territory, or a claim of legal professional privilege made in relation to a statement made at an examination under Division 2 of Part 3 of the ASIC Act, does not prevent the James Hardie material being admissible in evidence in a James Hardie proceeding. Of course, there may be other rules of evidence that may be relevant to the question of admissibility that are unaffected by this Bill.

4.29 Subclause 4(5) provides that a claim of legal professional privilege made by ASIC, the DPP or any other authorised person in relation to James Hardie material is not abrogated or affected by clause 4 of the Bill. This subclause ensures that legal professional privilege in advice sought by ASIC or the DPP concerning, for example, the conduct of a person involved in a James Hardie Group restructure event still applies.

4.30 This clause clarifies that James Hardie material in which privilege has been abrogated will still be taken to be privileged for the purposes of subsection 42(1) of the Freedom of Information Act 1982, subsection 33(2) of the Archives Act 1983 and subsection 197(2) of the Proceeds of Crimes Act 2002.

4.31 For example, subsection 42(1) of the Freedom of Information Act provides that a document is an exempt document under that Act if it is of such a nature that it would be privileged from production in legal proceedings on the grounds of legal professional privilege. Although the Bill will abrogate the privilege in James Hardie material (in certain circumstances), if the material would otherwise have been privileged, this clause provides that it is taken still to be privileged under the Freedom of Information Act. So, if a person were to make an application for access under the Freedom of Information Act to a privileged document that is James Hardie material, the agency to whom the request is made may refuse to grant access to that document on the ground that it is an exempt document because it would have been privileged (but for the operation of clause 4 of this Bill).

4.32 Clause 6 makes clear that the Bill abrogates legal professional privilege in James Hardie material only for the purposes of, or in connection with, a James Hardie investigation or a James Hardie proceeding but not otherwise. So, it would not be open to a third party to attempt to use privileged James Hardie material in some unrelated proceedings (that are not James Hardie proceedings).

4.33 In this regard, it is noted that the High Court in the Daniels case held that section 155 of the Trade Practices Act 1974 (the TPA) did not authorise the ACCC to require production to it of information and documents to which legal professional privilege attaches, because section 155 does not expressly abrogate the privilege.

4.34 In Corporate Affairs Commission (NSW) v Yuill (1991) 172 CLR 319 (the Yuill case), the High Court decided by a majority that under the provisions of the Companies (NSW) Code (which are substantially the same as ASIC’s compulsory powers in Part 3 of the ASIC Act under which ASIC is given the power to require a person to attend and answer questions at an examination, and to require the production of books relating to the affairs of a body corporate) the power of a NSW Corporate Affairs Commission inspector to compel production of documents was not subject to a claim of legal professional privilege. In that case, the High Court used a purposive interpretation of investigative powers under the former Commonwealth/State cooperative scheme for corporate regulation to find the necessary implication for excluding legal professional privilege within the framework of the relevant Code provisions.

4.35 Although the Daniels case dealt with section 155 of the TPA and not the provisions of the ASIC Act, the suggestion in the Daniels case that the Yuill case may now be decided differently has created some uncertainty as to whether the Yuill case would be followed if a request by ASIC to produce material subject to legal professional privilege was to be challenged. One of the judges in the Daniels case went so far as to say that, in his view, Yuill may have been wrongly decided.

4.36 The decision in the Daniels case does not mean that ASIC is unable to require production of information subject to legal professional privilege. In relation to the power to obtain information subject to legal professional privilege, ASIC has only sought such information where it is relevant and has not required production of such material as a matter of course. Since the Yuill decision in 1991, there have been no claims that ASIC has abused its power to obtain information or documents that were subject to legal professional privilege.

4.37 Clause 7 contains a regulation-making power, which will allow the regulations to prescribe certain events relating to the James Hardie Group as matters that may be included as part of a James Hardie investigation. This will ensure that if in the course of its investigations ASIC identifies matters that should be investigated (but were not dealt with by the James Hardie Special Commission of Inquiry), the provisions of the Bill will apply to ensure that any relevant material is available to ASIC.

4.38 The James Hardie Special Commission of Inquiry was asked to report within a limited time-frame, and was provided with limited resources to conduct its investigations. A significant number of issues were identified, but not fully explored. A large amount of material and information remains to be investigated. Given the complexity of the transactions entered into by James Hardie, it is possible that new matters relating to the James Hardie Group will be identified in the course of the upcoming comprehensive investigation.