Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda[Index] [Search] [Download] [Bill] [Help]

1998-1999-2000-2001

The Parliament of the

Commonwealth of

Australia

Explanatory

Memorandum

ISBN: 0642 466513

Parliamentary (Choice of Superannuation) Bill 2001

Parliamentary (Choice of Superannuation) Bill

2001

The Bill amends the Parliamentary Contributory Superannuation Act 1948

(the Act) to give Senators and Members of the House of

Representatives the freedom to opt out of the compulsory parliamentary

superannuation scheme.

Retiring Members and Senators currently receive

superannuation benefits from the Commonwealth as contributors to the

Parliamentary Retiring Allowances Trust (the Trust) established under the Act.

From the first day a Senator or Member becomes entitled to a parliamentary

allowance he or she is automatically obliged to make contributions to the

Trust.

The Bill allows new Senators or Members to elect not to make

contributions to the Trust upon first taking office, and instead, to make

contributions to a complying superannuation fund or Retirement Savings Account

(RSA) of their choice. The Bill gives current Senators and Members the same

choice, but will also allow them to have any superannuation benefit accrued

under the parliamentary scheme rolled-over into a complying fund or RSA of their

choice[1]. Once a new, current, or

returning Senator or Member has exercised the right to choose not to make

contributions to the Trust, he or she will not be able to make such

contributions in the future.

If a Senator or Member elects to opt out of

the Parliamentary scheme, he or she will also have superannuation contributions

paid into their chosen fund or RSA by the Commonwealth. These contributions will

be made in accordance with the Superannuation Guarantee (Administration) Act

1992.

The Superannuation Guarantee (Administration) Act 1992

is the legislation under which the majority of Australian workers currently

have superannuation contributions made on their behalf by their employers.

Therefore, those Members or Senators who exercise the freedom of choice the Bill

provides will have their superannuation arrangements brought in line with those

applying to the wider community.

The Government currently has

legislation before the Senate designed to give employees greater choice and

control over their superannuation arrangements. Senators and Members are,

however, exempted from the Government’s proposed choice of fund

arrangements. By allowing Senators and Members to choose the complying fund or

RSA into which their contributions are paid, the Bill seeks to give

parliamentarians the same freedom of choice the Government has already sought to

give other workers.

The Bill will result in the funding of future superannuation accruals for

new and existing Senators and Members who elect to join another complying

superannuation fund or an RSA. It is difficult to estimate the outlays that

might be required as this will depend on how many Senators and Members choose

not to contribute to the Trust. However, any increased cash flows do not

represent additional costs to the Commonwealth.

Members and Senators

who opt out of the parliamentary scheme will reduce the Commonwealth’s

liability from an unfunded commitment to be paid out of consolidated revenue to

the amount required under the superannuation guarantee scheme (currently 8% of

salary).

Despite a Senate Inquiry in 1997 which concluded the parliamentary scheme

lacks transparency, is out of step with superannuation practice in the wider

community and is in some cases excessively generous, there appears to be no will

on the part of the Government or Opposition to reform the scheme.

The

parliamentary scheme had its origins in an era when people contemplating public

office were considered more likely to face job insecurity than the rest of the

workforce. However, in 2001 there is no such thing as ‘job security’

or a ‘job for life’ for the vast majority of the Australian workers.

The nature of modern parliamentary life means many ex-parliamentarians

are now at a competitive advantage when they re-enter the general workforce

after time in politics. The generosity of the parliamentary scheme and loopholes

in the legislation governing it allow some parliamentarians to access large

entitlements prior to reaching retirement age.

By giving Members and

Senators the freedom to opt out of the parliamentary scheme the Bill simply

implements one of the key conclusions reached by the Government members of the

Senate Select Committee on Superannuation in 1997.

On the 25th of November 1996 the Senate asked its Select Committee on

Superannuation to inquire and report on the appropriateness of the parliamentary

superannuation scheme[2].

The

Committee received 46 submissions and held three public hearings before handing

down its report on the 1st of September 1997. In its report entitled The

Parliamentary Contributory Superannuation Scheme and the Judges’ Pension

Scheme the Committee concluded that:

• change to the

parliamentary superannuation scheme was desirable;

• the scheme was

out of step with superannuation practice in the wider

community;

• the scheme lacked transparency and that this lack of

transparency gave rise to much of the public criticism it attracted; and

• there was convincing evidence the scheme was excessively

generous to a small group of retiring

parliamentarians.[3]

According

to its report:

‘The Committee agreed that the scheme has many

significant shortcomings. It does not necessarily serve its members well, may

be outdated in some of its provisions and attempts to achieve too much in

relation to what a superannuation scheme can fairly be expected to

provide.

There is also a lack of transparency in parliamentary

superannuation that gives rise to much of the criticism of the PCSS. Further,

there is also clearly a negative perception in the mind of the public about the

scheme, and an uneasy relationship between the PCSS and superannuation in the

broader community. In light of these findings, the Committee considers that

reform is

desirable.’[4]

Regarding

issues of flexibility, portability and choice the Committee

said:

‘The result of the inflexible nature of the PCSS is a lack

of choice for individual parliamentarians. In view of the increasing prospect

of new members bringing to their parliamentary life substantial superannuation

as a result of other employment, it seems inefficient as well as unnecessary to

be requiring them to contribute to a scheme which may result in them exceeding

the Reasonable Benefit Limits or exceeding their own superannuation requirements

...

The Committee also recognises the lack of portability involved

in the parliamentary scheme. While it is possible for a member of the PCSS to

purchase a notional past service which will be taken into account in determining

future entitlements under the PCSS, this option is generally not taken up.

Then, on leaving parliamentary service, there is no transferability of a PCSS

pension entitlement to another scheme.

One possible solution to

these dilemmas is for membership of the PCSS to be optional, to the extent that

every parliamentarian is a member until he or she opts

out.’[5]

Government

members of the Committee recommended, among other things, that upon taking

office new parliamentarians should be offered the choice of opting out of the

parliamentary scheme in favour of a fully funded accumulation scheme or

retirement savings account of their

choice.[6]

The Australian Labor

Party Members of the Committee did not recommend specific changes to the scheme

but concluded the Remuneration Tribunal was the appropriate body to make

recommendations for

reform.[7]

In a dissenting

report on behalf of the Australian Democrats, Senator Lyn Allison expressed the

view that the scheme was too generous and was in urgent need of

reform.[8]

On the 1st of

December 1997 the Minister for Finance the Hon. John Fahey formally responded to

the report in a letter to the Committee’s Chair Senator John Watson. In

his response the Minister stated that:

‘The Government welcomes

your Committee’s report on its inquiry into the superannuation

arrangements for parliamentarians and judges. I note the committee members were

all of the view that the Remuneration Tribunal should be involved in setting

parliamentary

superannuation.’[9]

The

Minister went on to say that the Government would give further consideration to

the Committee’s findings in the context of changes then proposed to the

way Members of Parliament were paid. These involved setting

parliamentarians’ remuneration by reference to classifications determined

by the Remuneration Tribunal, rather than by direct linkage to public service

Senior Executive Service salaries.

Following the 3rd of October 1998

Federal election it was revealed that 33 year old Queensland Senator Bill

O’Chee, who had lost his seat after nine years service, would leave

Parliament entitled to an indexed lifetime pension of approximately $45,000 a

year. On the 7th of October 1998, in response to the public outcry over these

revelations, the Minister for Finance was reported to have pledged to review the

Parliamentary Superannuation

Scheme.[10]

On the 12th of

November 1998, the Minister for Financial Services & Regulation the Hon. Joe

Hockey introduced to Parliament the Superannuation Legislation Amendment

(Choice of Superannuation Funds) Bill 1998. That Bill proposed to amend the

Superannuation Guarantee (Administration) Act 1992 to give ordinary

employees a choice as to which fund their superannuation contributions are paid.

In his Second Reading Speech to the Bill the Minister said among other

things:

“The choice of fund arrangements are about giving

employees greater choice and control over their superannuation savings, which in

turn will give them greater sense of ownership of these savings. The

arrangements will increase competition and efficiency in the superannuation

industry, leading to improved returns on superannuation savings

...

The fundamentals of this reform are that employees get a

genuine choice as to which fund their superannuation is

paid.”[11]

This

legislation sought to implement a key recommendation of Stan Wallis’ 1997

report on the Australian Financial System. Recommendation 88 of that report

said in part:

‘Employees should be provided with choice of fund,

subject to any constraints necessary to address concerns about administrative

costs and funding

liquidity.’[12]

The

Government’s choice of superannuation legislation has been stalled in the

Senate since its introduction there in February 1999. However, parliamentarians

are currently excluded from the choice arrangements proposed by the

Government’s legislation. In other words, while the Government is of the

view that ordinary workers should have a genuine choice when it comes to their

superannuation arrangements, it has not sought to extend the same freedom of

choice to parliamentarians.

When asked in Parliament on the 24th of

November 1998 whether he supported a review of the parliamentary superannuation

scheme the Prime Minister replied: “I never close my mind to reviews of

superannuation, be it parliamentary or otherwise” but went on to

conclude “that you will never really solve the problem. I say to those

who have recently joined this place – I say this to people on both sides

– that if you imagine you will solve the anomalies of all this within a

short space of time, you will

not.”[13]

On the

8th of February 1999, in response to a Question on Notice seeking confirmation

about the review he was reported to have proposed, the Minister for Finance

said: “the Government has not decided at this time on any review of the

Parliamentary Superannuation Scheme.”

[14]

On the 9th of March

1999 in response to another Question without Notice the Prime Minister said:

“I have never ruled, nor has the Government ever ruled out, further

examination of parliamentary superannuation

arrangements.”[15]

On

the 7th of December 1999 the Remuneration Tribunal reported to the Government on

the remuneration of Senators and Members. In its report the Tribunal

recommended that the method for setting the remuneration of Members of

Parliament should no longer be linked to the salaries of Senior Executive

Service Commonwealth public servants. Instead, the Tribunal proposed a new base

payment for backbenchers ($90,000p.a) and Office Holders to be adjusted twice

yearly in accordance with increases in Average Weekly Ordinary Time Earnings

index (the AWOTE). The Tribunal concluded that with these changes it was

‘satisfied that the remuneration package for Senators and Members

(salary, superannuation, and vehicle) is now

competitive’.[16]

However, the Tribunal gave no justification as to why

parliamentarians’ superannuation arrangements were considered

appropriate.

Much of this section has been extracted from the 25th Report of the

Senate Select Committee on Superannuation, The Parliamentary Contributory

Superannuation Scheme & the Judges’ Pension Scheme. For full

details of the parliamentarians’ superannuation arrangements readers are

directed to that report[17].

The parliamentary superannuation scheme provides for the superannuation

benefits of Commonwealth parliamentarians. Membership is compulsory and member

contributions are required. Benefits are paid to former Members of Parliament

or, on their death, to their surviving spouse or orphan children.

The

scheme is administered by the Department of Finance under the direction of the

Parliamentary Retiring Allowances Trust. There are five trustees of the Trust

– the Minister for Finance who is the presiding trustee, plus two Senators

and two Members of the House of Representatives appointed by their respective

Houses.

The parliamentary superannuation scheme was established in 1948 under the

Parliamentary Contributory Superannuation Act of that year. Reasons for

the establishment of the scheme included:

• entering Parliament

often meant foregoing potential superannuation pay-outs from previous employers

due to leaving that employer prior to retirement age;

• electoral

or parliamentary demands reduced members’ chances to re-establish careers

when their parliamentary term was over; and

• the need to entice

people to enter Parliament who would not otherwise nominate.

When then

Prime Minister and Treasurer Ben Chifley introduced the legislation in 1948 he

said:

It has frequently been said that the loss and insecurity which

attend upon service in Parliament deter men and women capable of making a

worthwhile contribution to the service of the Commonwealth from offering

themselves for election. It is hoped that this measure will help in overcoming

difficulties of this

nature.[18]

Originally

the scheme was funded to the extent of the member contributions, and was framed

along the lines of the Commonwealth Public Service Superannuation

Scheme.

Contributions were three pounds per week (about 10.4 per cent of

salary) and a fixed annuity of eight pounds per week was payable when a member

qualified for a pension, an amount which, according to Prime Minister Chifley

was in 1948: “much less than the maximum pension provided under many

private and public superannuation

schemes”.[19]

Between

1948 and 1973, the main amendments to the scheme were:

• in 1955,

the three occasions rule was introduced (see below);

• from 1959,

the age at retirement became a factor in fixing the rate of

pension;

• orphan benefits were introduced in 1959;

and

• from 1963, pensions changed from a fixed amount to being

based on salary.

In 1973 the scheme underwent major changes. The fund

was abolished and its assets transferred to the Consolidated Revenue Fund (CRF).

Contributions were then paid into the CRF, out of which benefits were also

paid.

The maximum benefit payable to a member was increased from 50 per

cent to 75 per cent of the parliamentary salary payable, and pensions accrued

according to the length of service rather than age at retirement. Also, the

minimum age 40 requirement for the pension on involuntary retirement was

removed, and the minimum age on voluntary retirement was raised from 40 to 45

years (eventually removed in 1978). Provisions for invalidity pensions,

indexation of pensions and the recognition of State parliamentary service were

also introduced.

Since 1973, various amendments have been made including

the introduction of a 50 per cent commutation of pension option in 1978. This

option was increased to a 100 in 1979. Further changes in the same period

included:

• reducing the 100 per cent commutation option back to 50

per cent in 1983; and

• the provision for reducing a pension, on

the basis of the former parliamentarian receiving remuneration from an Office of

Profit under the Crown, was reintroduced in 1983 (it had been removed in

1973).

The level of the superannuation contributions made for parliamentarians

by the Commonwealth is set by the Parliamentary Contributory Superannuation

Act 1948. Members and Senators must contribute at the rate of 11.5 per cent

of their Parliamentary Allowances for the first 18 years in office and at 5.75

per cent for subsequent years. In addition, they must contribute the same

percentage of their Additional Office Holder Allowance if they hold a higher

office (such as ministerial).

The parliamentary scheme is also an

unfunded defined benefit scheme. ‘Unfunded’ means that the scheme

funds its benefit payments from annual Commonwealth appropriations.

‘Defined benefit’ means that members’ entitlements are, in

general, multiples of years of service and a percentage of salary. In such a

defined benefit scheme, the employer is responsible for providing the difference

between the benefit actually paid and what the member has contributed toward the

benefit.

Every three years the Australian Government Actuary provides

the Department of Finance with details of the long term cost to the Commonwealth

of funding parliamentarians’ superannuation. At each review, the notional

employer contribution rate is reported. This rate illustrates the effective

cost of parliamentary superannuation benefits as a percentage of the total

salaries of scheme members. As at the 30th of June 1996 the rate was 69.1 per

cent.[20] The Actuary has prepared

a subsequent report for the Department of Finance based on 30th of June 1999

figures, but has not released this information publicly.

Based on the

current allowance for backbenchers of $92,000, the 69.1 per cent figure means

that in order to fund a member’s superannuation benefits, the Commonwealth

effectively contributes the equivalent of $63,572 extra per year.

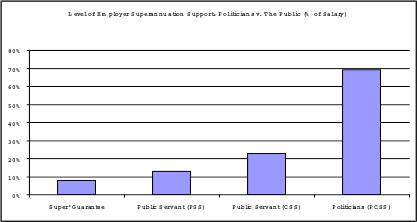

Compared to the majority of Australian workers this level of employer

contribution for superannuation is very generous. The generosity of the scheme

is demonstrated by comparing it with other superannuation schemes operated by

the Commonwealth for its public servants and the wider public. Based on the

1996 figures, under the Commonwealth Superannuation Scheme (CSS) the notional

employer contribution was 23 per cent, while for the Public Sector

Superannuation Scheme (PSS) it was 13 per cent.

The generosity of the

parliamentary scheme is further demonstrated when it is compared with the level

of compulsory superannuation paid by most employers under the Superannuation

Guarantee (SG) scheme. The SG scheme requires all employers to make a minimum

superannuation contribution on behalf of employees (with limited exceptions).

For the year 2000-01 financial year the minimum level of employer support

superannuation is 8 per cent. When compared with the contributions under the

SG, the level of support parliamentarians receive is very generous as the

following table illustrates.

In 1994 the parliamentary superannuation scheme was amended to make it

subject to the same preservation rules applying to other superannuation funds.

New preservation rules, administered by the Australian Prudential Regulation

Authority, took effect from 1 July 1999. From this date, all superannuation

contributions (including member contributions) and superannuation fund

investment earnings have been preserved until fund members reach their

preservation ages[21].

In

the 1997 Budget the Government announced that the preservation age would be

increased from 55 to 60 on a phased in basis. By 2025, the preservation age

will be 60 years for anyone born after June 1964, with the age 60 preservation

age being reduced by one year for each year that person’s birthday is

before 1 July 1964. This means that a person born before 1 July 1960 will

continue to have a preservation age of 55.

Preserved superannuation

benefits can be accessed on limited compassionate and severe financial hardship

grounds. However, under the new preservation rules, a person continues to be

allowed to have early access to preserved benefits where they are taken in the

form of a non-commutable[22]

lifetime pension or annuity on termination of gainful employment. It is this

feature which allows parliamentarians to gain early access to their

superannuation entitlements. Such early access is, however, generally not an

option for most other workers until they are very close to

retirement.

This is because the generosity of the Parliamentary Scheme

(69.1 per cent of salary) provides Members and Senators with a much larger

entitlement after 8 or 12 years of service compared with a worker only receiving

the SG minimum amount (currently 8 per cent of salary). Logically, the

generosity of the parliamentary scheme ensures that on conclusion of his or her

parliamentary service, a Senator or Member can access a much larger

non-commutable lifetime pension or annuity than other workers.

Further,

although the preservation rules permit early access only in the form of

non-commutable pensions, the parliamentary scheme continues to allow

parliamentarians to take up to 50 per cent of their pension in a lump sum prior

to reaching preservation age[23].

This arrangement is directly at odds with those applying to the general

workforce who may not access their superannuation prior to reaching preservation

age unless the benefits are taken in the form of a lifetime pension or

annuity.

Clause 1 – Short title

Clause 1 provides for

the short title of the Act to be Parliamentary (Choice of Superannuation) Act

2001.

Clause 2 – Commencement

Subclause

2(1) provides for the Act to commence on the day that it is proclaimed.

However, choice decisions under the Act will not be able to be made until 1 July

2001 under new section 4F.

Subclause 2(2) provides that the

proclamation cannot be made unless the Parliament has appropriated funds for the

purposes of the Act.

This measure is necessary because a private Member

may not introduce a bill requiring the appropriation of public revenue, as an

appropriation must first be recommended to the House by message of the

Governor-General. This requirement reflects the constitutional and parliamentary

principle of the financial initiative of the Crown. As Parliament considers the

Bill it may then provide for the appropriation of funds for the payments to be

made to the superannuation funds or RSAs of the Members of Parliament who choose

not to make contributions to the Parliamentary Retiring Allowances Trust (the

Trust). After the appropriation is made the proclamation can be

issued.

Clause 3 – Schedule

Clause 3

provides that the Acts specified in the schedule are amended or repealed as set

out in the applicable items in the Schedule.

Schedule 1 –

Amendment of the Parliamentary Contributory Superannuation Act

1948

Item 1 – Subsection 4(1) definition of

member

Item 1 repeals the existing definition of

member and replaces it with a new extended

definition.

Item 2 – Subsection 4(1) definition of non

Trust contributor

Item 2 inserts a definition of the term

non Trust contributor.

Item 3 – Paragraph

4(4A)(aa) deeming a Member of Parliament to be employed by the

Commonwealth

Item 3 repeals the existing deeming provision and

replaces it with a new extended provision.

Item 4 – New

sections 4F and 4G provision of choice of superannuation fund and providing for

Commonwealth contributions to the chosen fund

Item 4 inserts

new section 4F into the Act to enable a Senator or Member to choose not

to contribute to the Trust. New subsection 4F(1) provides that a Member

of Parliament may continue to be or become a member of another complying

superannuation fund or the holder of a Retirement Savings Account (an

RSA).

New subsection 4F(2) provides that a Senator or Member may

not cease to contribute to the Trust until 1 July 2001. New paragraph

4F(2)(a) requires a Member or Senator’s decision to be given in

writing to the Trust and stipulates that if written notice is given, the

earliest the Senator or Member could become a non Trust contributor is the date

of that written notice.

New paragraph 4F(2)(b) applies to new

Senators and Members, and allows them to forgo being a contributor to the Trust

upon first entering parliament.

New subsection 4F(3) allows

Senators or Members to make their decision to opt out on first becoming entitled

to a parliamentary allowance or at any time they are a Member of Parliament. A

parliamentary allowance is any allowance as defined by section 4(1) of the Act

and is typically payable to a Member or Senator from and including the day of

his or her election to office.

New subsection 4F(4) stipulates

that once a Member or Senator has exercised their choice under the Act, they

must maintain membership of a complying superannuation fund or be the holder of

an RSA for the whole time they remain a Member of Parliament.

New

subsection 4F(5) has the effect that once a Member or Senator exercises

their choice under the Act, they will not be able to reverse their decision. The

decision to opt out of contributing to the Trust will be

permanent.

New subsection 4F(6) provides for definitions of

complying superannuation fund and RSA.

New section 4G compels the

Commonwealth to make contributions for the benefit of non Trust contributors, to

the complying superannuation fund or RSA chosen by the individual Senator or

Member, in accordance with the Superannuation Guarantee (Administration) Act

1992. This measure means that Members and Senators who choose not to

contribute to the Trust will have superannuation contributions paid on their

behalf by the Commonwealth at the minimum rate payable under the superannuation

guarantee scheme.

Item 5 – Subsection 13(9)

definitions

Item 5 repeals the existing definition provision

for section 13 and replaces it with a new extended provision. In new

subsection 13(9) definitions of Minister of State,

office holder and person applying only in section 13

have been inserted. Each definition has a common requirement for the person to

be a contributor to the Trust. The effect of the definitions is to limit the

scope of section 13 to those persons entitled to a parliamentary allowance,

Ministers of State and office holders who make contributions to the Trust. Those

persons who elect not to make contributions to the Trust are excluded from the

requirement to make contributions.

Item 6 – Section 18A

benefits for members who cease to make contributions to the

Trust

Item 6 inserts new section 18A into the Act

stating that the only benefit for Senators and Members who choose to stop making

contributions to the Trust is the superannuation guarantee safety-net amount.

However, as is the case for all other employees, this benefit must be rolled

over into the complying superannuation fund or Retirement Savings Account of the

Senator or Member.

The superannuation guarantee safety-net amount has the

meaning given by section 16A of the Act.

[1] The Bill proposes that a Member

or Senator’s benefit on exercising their choice to opt out of the Trust

will be the ‘superannuation guarantee safety-net amount’ as defined

by section 16A of the Act.

[2] The

full Terms of Reference the Committee was asked to inquire and report on

were:

1) The appropriateness of the current unfunded defined benefit

superannuation schemes’ application to judges and parliamentarians,

including but limited to:

(a) the equity between members;

(a) the cost

to the Commonwealth and members;

(a) the impact of unfunded liabilities on

future budgets;

(a) the advantage or otherwise of member choice of fund or

investment strategy;

(a) the flexibility of existing schemes, including in

respect of portability, in the context of their working arrangements and those

applying in the general work force;

(a) the appropriateness of replacing such

schemes with a fully-funded accumulation scheme;

(a) the appropriateness of

the application of preservation rules and taxation on benefits taken prior to

age 55 to such schemes;

(a) the capacity for making superannuation

arrangements less complex than current arrangements; and

(a) the

administrative cost of such arrangements and their alternatives.

2)

That for the purpose of the inquiry the committee take evidence from the public,

Government agencies and State, Territory and Federal government departments, and

conduct public hearings as

appropriate.

[3] The

Parliamentary Contributory Superannuation Scheme & Judges Pension

Scheme, Senate Select Committee on Superannuation, 25th Report,

Parliament of the Commonwealth of Australia, Canberra, 1st September

1997, p. 41.

[4] The

Parliamentary Contributory Superannuation Scheme & Judges Pension

Scheme, Senate Select Committee on Superannuation, 25th Report,

Parliament of the Commonwealth of Australia, Canberra, 1st September

1997, p.3.

[5] ibid, at

p.27.

[6] ibid, at

p.42.

[7] ibid, at

p.43.

[8] Senator Lyn Allison,

Dissenting Report, Senate Select Committee on Superannuation, 25th

Report, The Parliamentary Contributory Superannuation Scheme & Judges

Pension Scheme, Parliament of the Commonwealth of Australia, 1st

September 1997, p.1.

[9] The Hon.

John Fahey, Minister for Finance, Government Response to Senate Select Committee

on Superannuation’s, 25th Report, The Parliamentary

Contributory Superannuation Scheme & Judges Pension Scheme,

1st December

1997.

[10] Peatling, Stefanie,

“Fahey Pledges Super Review”, Sydney Morning Herald,

7th October 1998,

p.10.

[11] The Hon. Joseph

Hockey, Minister for Financial Services and Regulation, House of Representative

Hansard, 12th November 1998,

p.261.

[12] Australian

Financial System Inquiry, Final Report (Wallis Report), Canberra, Australian

Government Publishing Service, March

1997.

[13]The Hon. John Howard,

Prime Minister, House of Representatives Hansard, 24th November 1998,

p.481.

[14]The Hon. John Fahey,

Minister for Finance and Administration, House of Representatives Hansard,

8th February 1999,

p.2165.

[15]The Hon. John Howard,

Prime Minister, House of Representatives Hansard, 9th March 1999,

p.3443.

[16]Report on

Senators and Members of Parliament, Ministers and Holders of Parliamentary

Office – Salaries and Allowances For Expenses of Office, Remuneration

Tribunal, December 1999, p.10.

[17] The Parliamentary

Contributory Superannuation Scheme and Judges Pension Scheme, Senate Select

Committee on Superannuation, 25th Report, Parliament of the

Commonwealth of Australia, Canberra, 1st September

1997.

[18] The Hon. Ben Chifley,

Prime Minister and Treasurer, House of Representatives Hansard, 1st

December 1948, p. 3738.

[19]ibid,

at p. 3739.

[20] The

Parliamentary Contributory Superannuation Scheme & Judges Pension

Scheme, Parliament of the Commonwealth of Australia, 1st

September 1997, p. 15.

[21]

Preservation Age is the age at which a fund member can gain access to benefits

that have accumulated in a superannuation fund or RSA, provided the member has

permanently retired from the

workforce.

[22] Commutation

refers to the taking of a benefit in a lump

sum.

[23] Parliamentary

Contributory Superannuation Act 1948 Cth, Section 18B.